Elliott Wave Theory/Principle (EWT) is a financial-oriented technical analysis method discovered by American accountant Ralph Nelson Elliott. It is one of the most preferred and usable methods in the world of finance. To simplify the theory; It explains that the prices updated and included in the markets progress in repetitive cycles and the predictability of these developments.

Today, in many markets and sectors, this principle is used both to determine the future gpals and to take the right steps. It has an impact in different areas such as income-expenditure balance, price increase / decrease analysis, stock and crypto sector.

How Does Elliott Wave Theory Work?

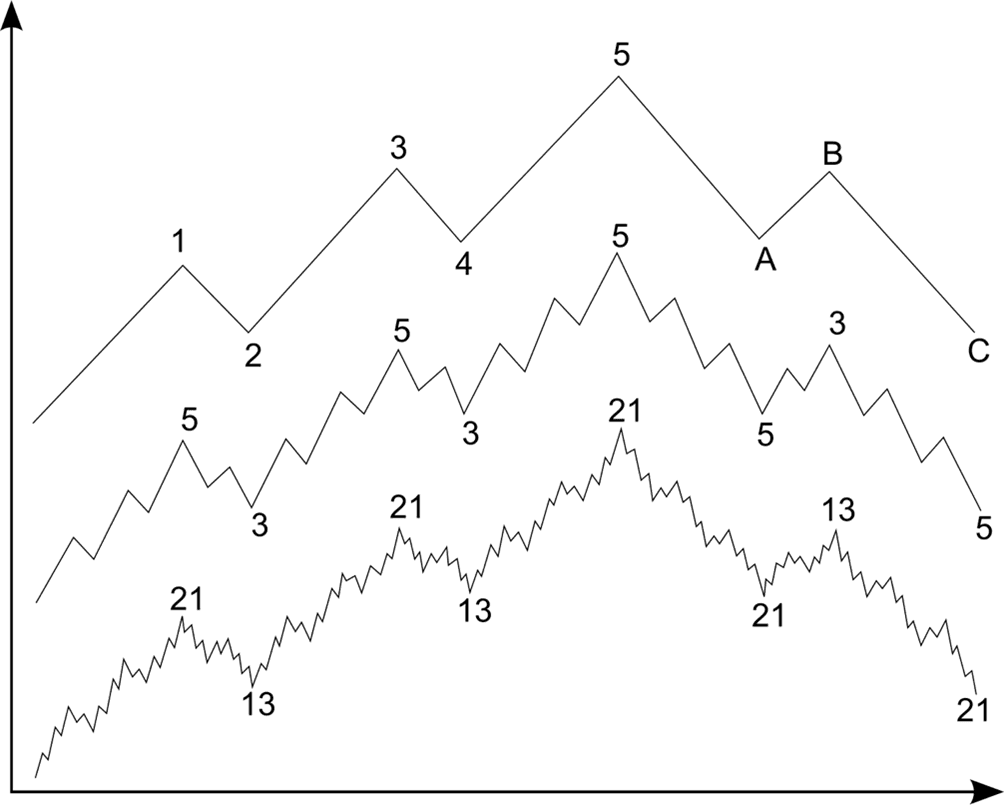

Elliott Wave Theory, basically proceeds as five waves (impulsive) going in a row followed by +3 waves coming in as corrective waves. Waves that go in this 5+3 pattern form a regular structure/fractal over time. The 5 waves are called impulsive, and the next 3 waves are called corrective waves. These wave classifications also have their own rules. Each completed 8 wave pattern becomes the beginning or one of the steps of the next pattern. These waves represent prices, while wave patterns represent general markets.

Also, Elliott Wave Theory has a connection with the “Swarm Behaviour” that people have. Swarm Behaviour covers both the public’s reactions to current public problems/situations and the common behavior of investors. Naturally; In the context of optimism and pessimism that occurs between all these behaviors, the fluctuations we mentioned occur.

As can be seen in the chart, impulsive 1, 3 and 5 continue with corrective waves like 2 and 4 step by step. This series is only part of the next larger wave patterns.

As can be seen in the chart, impulsive 1, 3 and 5 continue with corrective waves like 2 and 4 step by step. This series is only part of the next larger wave patterns.

Wave Degrees

Grand supercycle: Multi-century

Supercycle: Multi-decade

Cycle: A year- several years

Primary: A few months to two years

Intermediate: Weeks to months

Minor: Weeks

Minute: Days

Minuette: Hours

Subminuette: Minutes

Wave Rules

There are 3 basic rules of the five-wave structure observed in the graph. These:

- Wave 2 cannot be longer than Wave 1, that means, it cannot rise above the starting point of Wave 1 in terms of price.

- In the 1-3-5 series, Wave 3 cannot be the shortest, at the same time Wave 5 must be longer than Wave 3.

- Wave 4 cannot rise above the starting point of Wave 3.

How can we use Elliott Wave Theory to Predict the Behavior of Cryptocurrencies?

As we mentioned before, this model is one of the most frequently used forecasting/analysis methods in financial markets. Unlike other analysis methods, its connection with psychology also increases its scientific reliability.

In order to make predictions with the Elliott Wave Principle in the crypto money industry, first of all, it is necessary to have graphic drawing tools and knowledge. After the 8 impulsive and corrective waves of the focused crypto money, which is the essential module of the above-mentioned pattern, are determined, comments and opinions in accordance with the rules of the principle should be put forward.

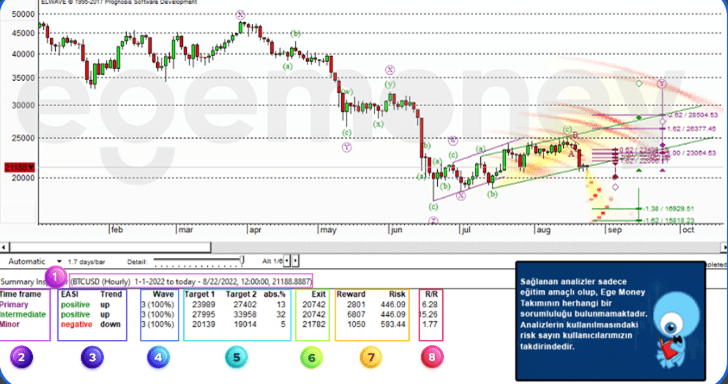

Using special online tools for these greatly increases the accuracy of your predictions. EgeMoney Exchange offers this analysis tool to its customers free of charge and makes your work easier with the date/coin-based search option. You can find analysis of BTC, ETH, BNB, DOGE, XRP, LTC, BCH, TRON, ADA, XLM and SOL related to this principle in the tool.

After selecting the crypto you are interested in, you can make a crypto prediction with Elliott Wave Theory, thanks to this chart. EgeMoney offers you a free data stream that is always up to date and accessible.

After selecting the crypto you are interested in, you can make a crypto prediction with Elliott Wave Theory, thanks to this chart. EgeMoney offers you a free data stream that is always up to date and accessible.

Elliot Dalga Prensibi Rehberi

In addition, you can automate your related tasks of following and reading charts with the EgeMoney Telegram Bot. To have more information about the market, do not forget to check the analysis at blog.egemoney.com and follow us.