With the rising popularity of digital currencies, investors and traders use analysis methods to predict price movements and support their decisions.

With the rising popularity of digital currencies, investors and traders use analysis methods to predict price movements and support their decisions.

What is digital currency?

Digital currencies are decentralized digital currencies that are used in digital environments. They secured by encryption technology. Unlike traditional currencies, digital currencies don’t have central authorities. These features and advantages have made them popular in recent years. Examples of digital currencies include Bitcoin, Ethereum, Litecoin, Ripple, and Cardano.

Commonly used analysis methods in digital currencies:

Fundamental Analysis: Examines the fundamental factors that influence the value of a digital currency. Economic indicators, news, technological developments, regulations, and similar factors are the focus of fundamental analysis. This analysis method is used to understand the long-term trends and fundamental value of a digital currency.

Technical Analysis: Technical analysis focuses on predicting future price movements by analyzing past price movements and using statistical data. Charts, indicators, and mathematical models are the fundamental tools of technical analysis. This analysis method is used to determine short and medium-term trends of a digital currency. Also, it identify entry and exit points.

News-Based Analysis: Evaluates the impact of news and announcements on prices. News and announcements have the potential to create volatility in digital currency markets. So, this analysis method attempts to predict price movements by following news flow.

Stock Market Analysis: Digital currencies sometimes exhibit similar movements to traditional stock markets. Therefore, stock market analysis can be used in some cases to predict the movements of digital currencies. Technical analysis tools and indicators used in stock market analysis can also be applied to digital currencies.

Quantitative Analysis: Predicts the performance of digital currencies using data analysis models. For example, price-volatility relationships are evaluated in this analysis method.

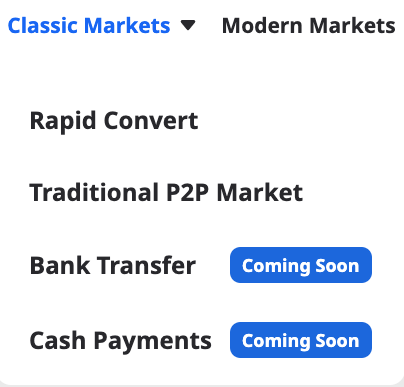

EgeMoney Digital Markets

In EgeMoney, you can trade with the digital currency of your choice in the available markets. The Spot Market, P2P, and Convert features are the currently available markets that can also be used for investment purposes.

Spot Market is a type of market based on instant delivery and payment. In this market, buyers and sellers exchange assets, and transactions are usually executed immediately. In spot markets, the transaction prices are determined at the time of the agreement. For example, there are spot markets for currencies and stocks.

P2P market is used for direct asset exchange between traders. This market is based on conducting transactions without central authorities. Buyers and sellers communicate directly with each other. Also, they determine transaction details through mutual agreement. The trading of digital assets such as cryptocurrencies is commonly seen in these markets. P2P markets reduce dependence on central authorities. Another key point is, it enable more direct interaction among users.

With EgeMoney Rapid Convert, you can convert different types of assets. If you are unfamiliar with how to use Rapid Convert, click here. Don’t forget to follow EgeMoney Academy for more.