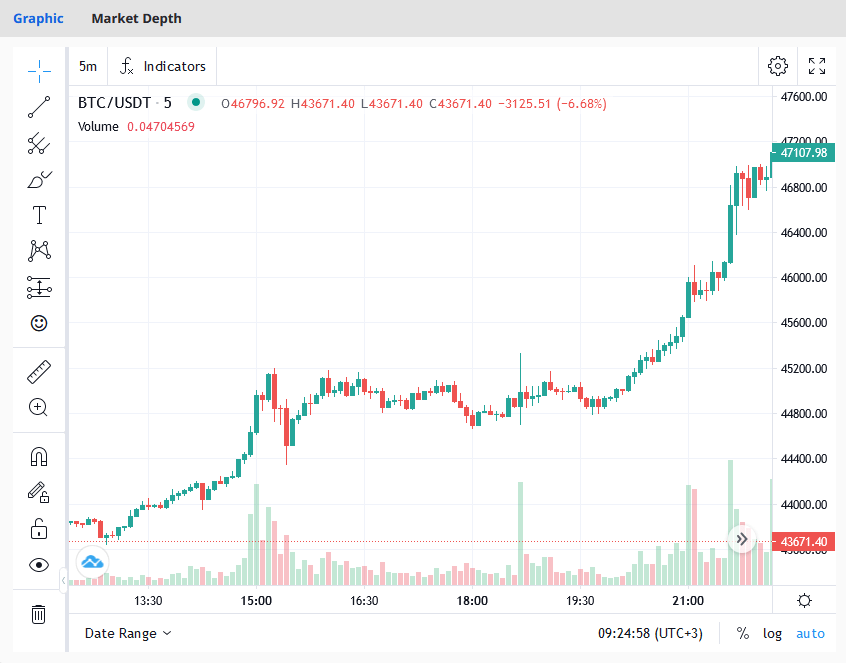

On January 8th, Bitcoin (BTC) surpassed $47,100 and reached $47,162, fueled by expectations of imminent approvals for spot Bitcoin ETFs. Meanwhile, Bitcoin’s market value was approximately around $918 billion.

In addition to Bitcoin’s daily gains, other top ten cryptocurrencies also experienced an upswing. Within 24 hours, Bitcoin (BTC) gained 6.2%, Ethereum (ETH) 4.8%, Cardano (ADA) 4.6%, Avalanche (AVAX) 2.6%, Solana (SOL) 3.8%, and Ripple (XRP) 2.0%. The entire cryptocurrency market gained 4.0% during this 24-hour period.

Bitcoin’s current value represents a 21-month high not seen since April 2022. Following the previous peak, there was a long-term price decline due to the collapse of TerraUSD and various crypto lending services. However, the long-term price recovery that began in January 2024 is still ongoing.

Probability of ETF Approval Linked to Gains

While there are many factors influencing Bitcoin’s price, hope for the approval of spot Bitcoin exchange-traded funds (ETFs) stands out as one of these factors.

Especially, CNBC reported based on two sources, that a series of ETFs are expected to be approved in the near future. The news channel stated that these funds are likely to be approved on Wednesday, January 10th, and trading is expected to commence on Thursday, January 11th, or Friday, January 12th.

Positive news continues to surround Bitcoin ETFs. Standard Chartered predicts that Bitcoin ETFs could bring in between $50 billion and $100 billion to the crypto market throughout 2024. VanEck has purchased $72.5 million worth of Bitcoin to launch its ETF, and a ‘fee war’ has emerged among Grayscale and other companies offering competitive fees.

Despite SEC Chairman Gary Gensler’s negative stance, he has indicated signs of new crypto products on the horizon, issuing a warning about Bitcoin investments.

In recent weeks, the U.S. Securities and Exchange Commission (SEC) has engaged with asset managers and accepted changes from applications. This could potentially boost investor sentiment, increasing demand for Bitcoin and raising its market value.