This Week’s Economic Calendar

| Date | Time | Currency | Event | Expectation | Previous Month’s Data |

|---|---|---|---|---|---|

| June 3, Monday | 10:00 | TRY | Consumer Price Index (CPI) (Yearly) (May) | 74.80% | 69.80% |

| June 5, Wednesday | US House Financial Services Subcommittee meeting on Real World Assets Ecosystem | ||||

| June 5, Wednesday | ATOM | ATOM V17 Upgrade | |||

| June 7, Friday | USD | Nonfarm Payrolls (May) | 185K | 175K | |

| June 7, Friday | USD | Unemployment Rate (May) | 3.9% | 3.9% | |

| June 7, Friday | USD | Average Hourly Earnings (Monthly) (May) | 0.3% | 0.2% |

Inflation Data in Turkey

We started this week in Turkey by receiving inflation data. The annual Consumer Price Index (CPI) was announced at 75.45%. In May, the main items with the highest monthly increases in CPI were cocoa with 15.51%, men’s clothing with 12.03%, and women’s clothing with 9.39%.

Trump’s Strategy to Gain Cryptocurrency Supporters

According to Bitcoin Magazine, Donald Trump has become the first U.S. president to accept Bitcoin via the Lightning Network. Aiming to win over cryptocurrency supporters ahead of the presidential elections in November, Trump stated that he approaches the cryptocurrency industry “positively and open-mindedly.” Bloomberg claims that Trump discussed cryptocurrencies with Elon Musk. However, Elon Musk denied this claim, stating, “I’m quite sure I haven’t discussed cryptos with Trump, but I generally like things that transfer power from the government to the people, which crypto can do.”

Biden Vetoes Repeal of SAB 121

Joe Biden vetoed a decision that would invalidate SEC Accounting Bulletin No. 121 (SAB 121), which sets accounting and reporting standards for cryptocurrencies and other digital assets. Biden stated that it would be wrong to oppose this regulation as it would weaken the authority of the SEC (Securities and Exchange Commission). He also emphasized that he would not support steps that would risk the welfare of consumers and investors.

Brock Pierce’s Message on China’s Return to Cryptocurrencies

Brock Pierce, one of the co-founders of Tether, announced that he is considering returning to Hong Kong, where he launched his stablecoin a decade ago. Pierce’s statements align with Hong Kong’s efforts to re-attract the crypto industry. However, he did not provide detailed information about his plans or whether Hong Kong would be a permanent base. Despite the Chinese mainland’s strict stance on commercial crypto activities, many see Hong Kong as a potential gateway to the broader Chinese market. Pierce maintains his optimism about the future, believing that a return of cryptocurrency from China is inevitable, though the timing remains uncertain. Discussing Hong Kong’s regulatory structure, he praised the city’s progress in providing clarity to investors and believes Hong Kong has an advantageous position compared to other regional players like Singapore, Japan, and South Korea.

$112 Million in Dogecoin in 72 Hours

In a post dated May 31, Ali Martinez highlighted significant purchases by Dogecoin whales. According to Martinez’s data, whales bought over 700 million DOGE worth $112 million in the last 72 hours. This was the first major purchase in a long time, clearly indicating the whales’ bullish expectations. While DOGE’s 24-hour trading volume reached $650 million, there was no noticeable increase in its price.

BTCD (Bitcoin Dominance)

Last week, Bitcoin’s market dominance was at 53.88%, but this week it rose to 54.50%. Bitcoin dominance represents Bitcoin’s share of the total cryptocurrency market, and changes in this ratio provide important insights into the overall market situation. An increase in Bitcoin dominance indicates growing confidence and interest in Bitcoin among investors. Typically, a rise in Bitcoin dominance is associated with investors moving from altcoins to Bitcoin. This shift can be due to various factors. For instance, during periods of market uncertainty, investors may turn to Bitcoin, which they see as a safer haven. This causes Bitcoin’s market value to increase more rapidly compared to other cryptocurrencies. Over the past week, the increase in Bitcoin dominance reflects general trends in the cryptocurrency market. Volatility in the altcoin market and uncertainties in some altcoin projects may have driven investors towards Bitcoin. Additionally, Bitcoin’s recent price performance may have attracted more investment. The rise from 53.88% to 54.50% in Bitcoin dominance indicates that Bitcoin’s influence on the market has strengthened. This shows that Bitcoin is being increasingly adopted not only as a store of value but also as an investment vehicle. Bitcoin’s high liquidity and broader acceptance make it an attractive option for investors. This trend is further reinforced by the growing interest of institutional investors in Bitcoin. The increase in Bitcoin dominance also affects the dynamics of the cryptocurrency market. Altcoin projects are generally sensitive to Bitcoin’s market movements, and an increase in Bitcoin dominance can put pressure on the altcoin market. This can negatively impact the price performance of altcoin projects and lead investors to reevaluate their portfolios.

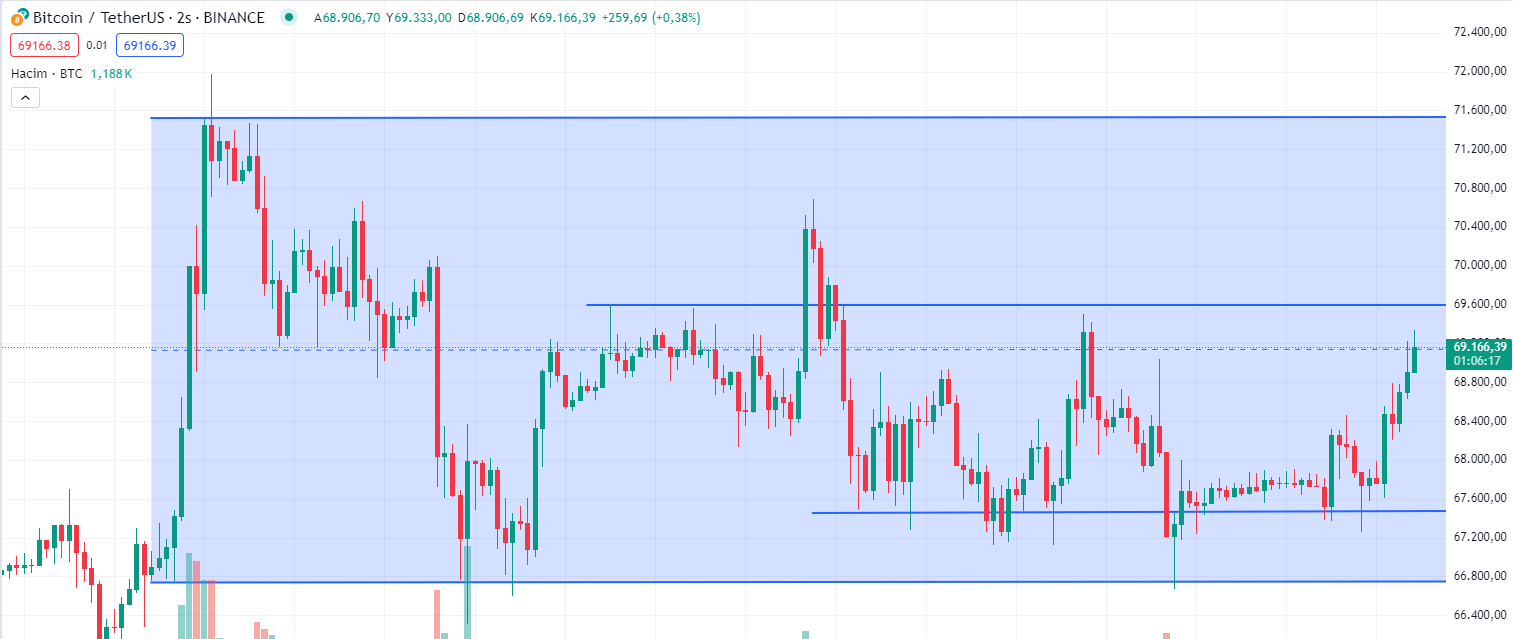

BTC:

We see that Bitcoin has been moving within a horizontal channel for a while. For us to discuss our bullish expectations, it needs to surpass the resistance level of 69,600 USDT. At the time of writing, Bitcoin is hovering around 69,200 USDT. On the downside, the level of 67,600 USDT is critically important. If it breaks the major support at 67,000, the sell-offs could deepen. Non-farm payroll data will be announced on Friday, which will significantly impact the dollar index and, consequently, have an indirect effect on cryptocurrencies. Considering Friday, using “Take Profit” and “Stop Loss” orders in our trades will be more beneficial for the health of the trades.

“This research report’s investment information and comments do not constitute investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.