Lawyers argue that it is impossible for Kwon to be in the U.S. Being detained in Montenegro prevents him from submitting a written statement to the SEC and violates his right to a fair trial.

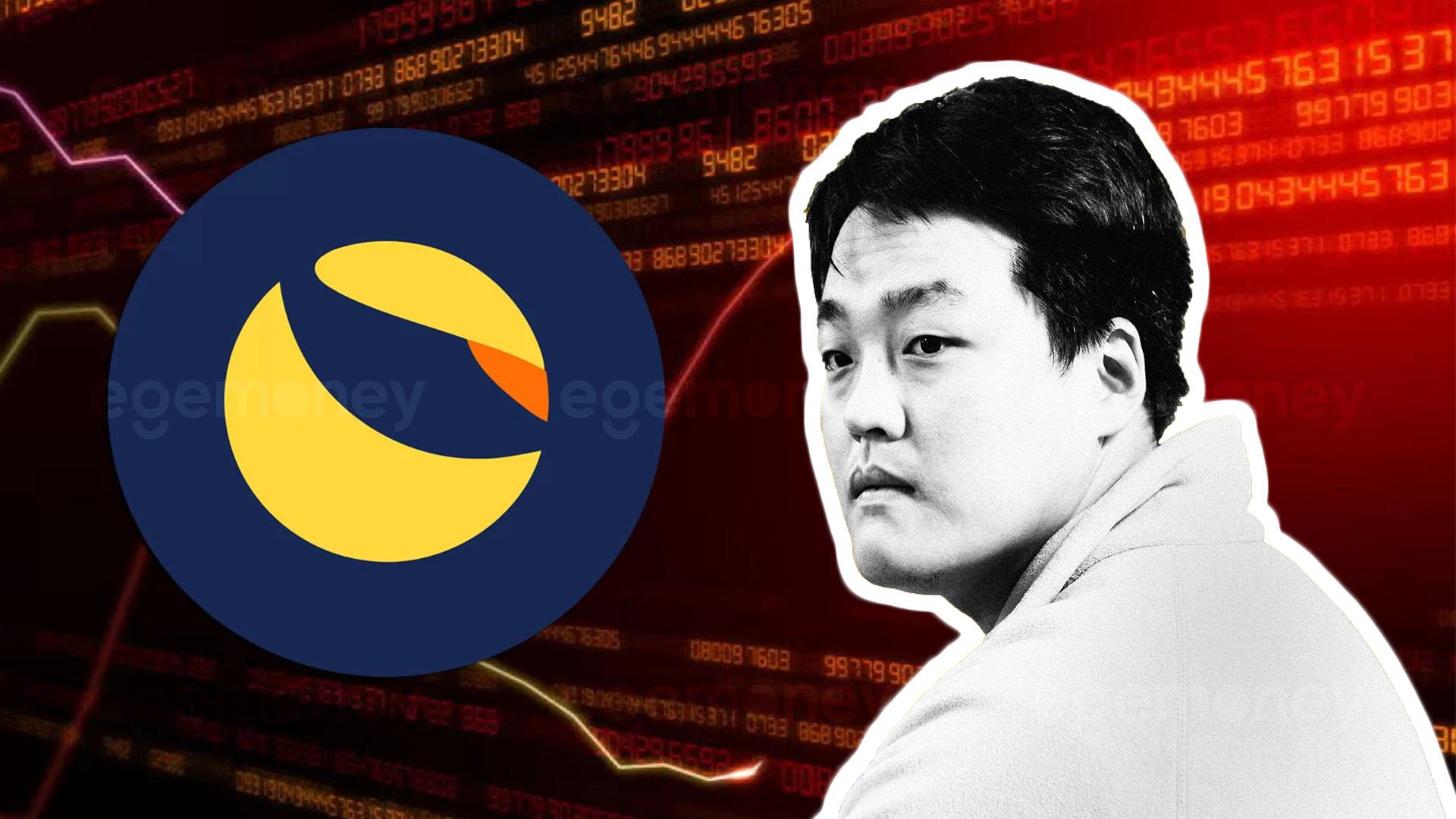

Terraform Labs’ founder Do Kwon submitted a court petition to reject a request from the United States Securities and Exchange Commission (SEC) to be questioned in the U.S. about the major crash of his company’s Terra and Luna tokens. Kwon’s lawyers are adamantly opposed to the stablecoin creator having an opportunity to give a statement to U.S. regulators.

The lawyers state that it is ‘impossible’ for Kwon to be in the U.S. as he is indefinitely detained in Montenegro. They also argue that submitting a written statement would violate his right to a fair trial under American law.

SEC Wants TFL Founder Do Kwon to be Quickly Questioned

The SEC emphasized the need for Do Kwon to be quickly questioned and requested permission from the court before the October 13 discovery deadline. However, Kwon’s legal team is opposing this proposal. They say that an order forcing something impossible has no practical purpose and would weaken judicial authority.

Kwon’s lawyers had previously argued that it was inappropriate for the SEC to try to regulate cryptocurrencies with outdated laws. Especially considering that there is no consensus between Congress, the executive, and agencies on what constitutes a ‘security,’ they claimed that this regulation was inappropriate.

The Lawsuit Filed by the SEC Against Terraform Labs

In February, the SEC filed a lawsuit against the Terraform Labs company. They claimed that the company provided false information to investors about the security of its stablecoin, TerraUSD. This stablecoin was designed to offer investors up to a 20% yield and promised to maintain its dollar equivalence through a mechanism linked to its corresponding Luna coin.

The lawsuit alleges that the defendants violated both the Securities Act and the Exchange Act’s registration and anti-fraud provisions. On the other hand, the major drop experienced by TerraUSD and Luna in May 2022 led to a staggering loss of $60 billion in the total market value of the Terra ecosystem. This event caused a value loss of $300 billion across the entire cryptocurrency sector