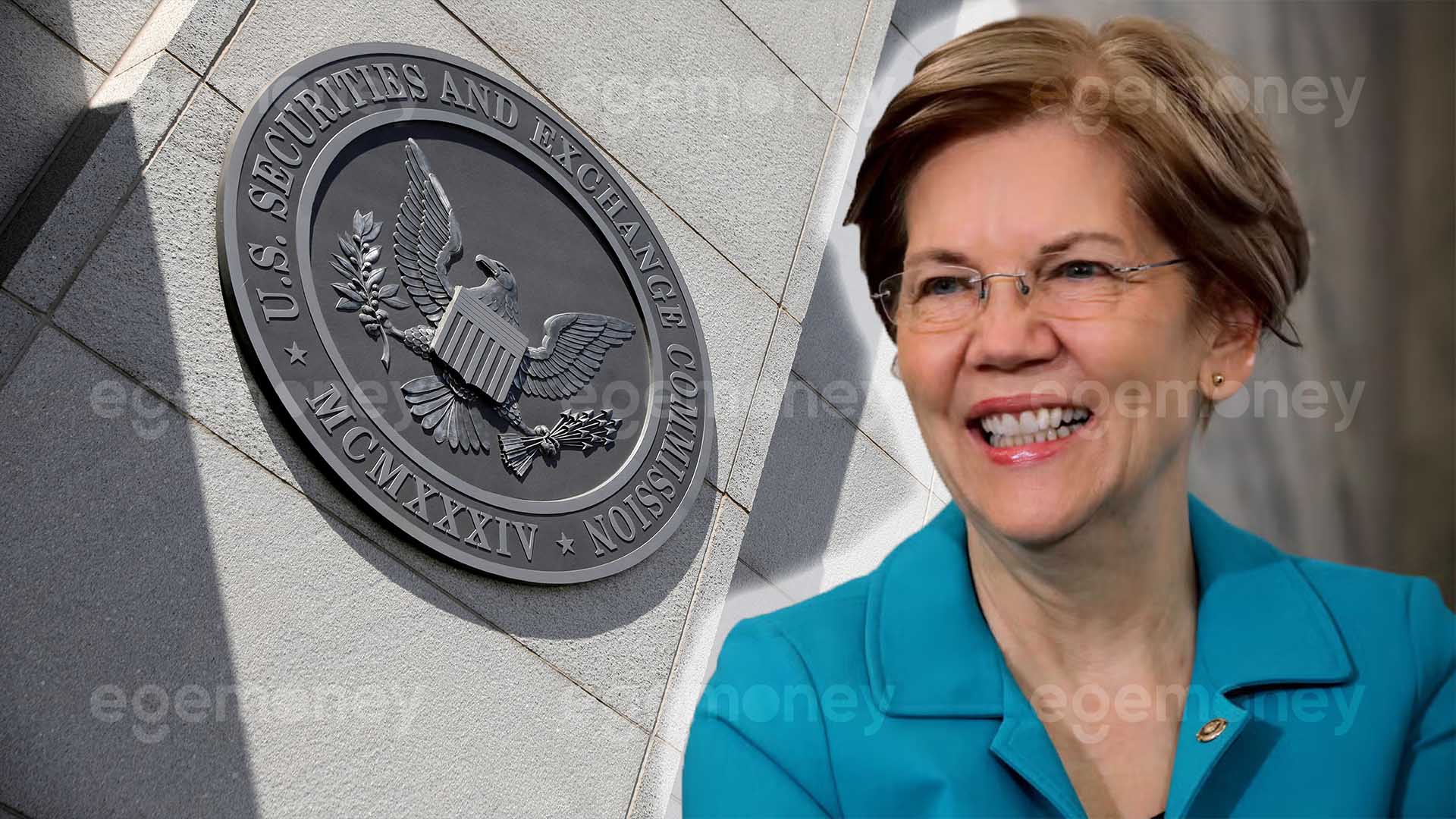

Senator Elizabeth Warren criticized the SEC’s decision on Bitcoin ETFs, emphasizing the need for stricter anti-money laundering regulations.

On January 11th, Senator Elizabeth Warren stated that the U.S. securities regulator’s decision to approve spot Bitcoin ETFs was incorrect.

Warren noted in a writing:

“The SEC is wrong on the law and wrong on the policy with respect to the Bitcoin ETF decision. If the SEC is going to let crypto burrow even deeper into our financial system, then it’s more urgent than ever that crypto follow basic anti-money laundering rules.”

It is not yet known what Warren’s specific criticisms are, and it is unclear whether she will send a letter to the SEC on these issues in the future.

However, the final part of her statement seems to suggest that beyond ETFs, there is a need to expand anti-money laundering regulations. Warren continues to push forward the Digital Asset Anti-Money Laundering Act, which she brought up again in July 2023. The content of this bill is generally applicable to the cryptocurrency industry.

Some members of the SEC seem to be receptive to Warren’s fight against crypto crimes. SEC Chairman Gary Gensler, who approved the spot Bitcoin ETFs, drew attention to crypto crimes, crime, and terrorism in his approval statement and warned users about the “numerous risks” associated with Bitcoin.

SEC Commissioner Caroline A. Crenshaw, who showed a difference of opinion, noted that Bitcoin markets are “full of fraud and manipulation” and lack adequate oversight.

Grayscale Case and the SEC’s Bitcoin ETF Decisions

Warren’s criticisms of the ETFs have sparked significant reactions on social media. Some commentators have argued that a decision related to Grayscale‘s ETF application led to the SEC’s approval of various spot Bitcoin ETFs. This situation seems to contradict Warren’s claim that the SEC was “legally wrong.”

However, the outcome of the Grayscale case does not obligate the SEC to approve any fund. Gensler acknowledged that the outcome of the Grayscale case was one of the factors determining that approving spot Bitcoin ETFs was the “most sensible route,” but he did not say that the SEC was obliged to approve.

The Grayscale decision required the SEC to review its spot Bitcoin ETF application. The court found that the SEC did not sufficiently explain its rationale for rejecting the application in light of its previous approvals of Bitcoin futures ETFs.