What will we see on the economic agenda this week?

| Date | Time | Exchange | Case | Expectation | Data announced last month |

| 28.03.2024 | 15:30 | USD | Gross Domestic Product (GDP) of the United States | 3,2% | 4,9% |

| 28.03.2024 | Final Penalty Decision Announcement Regarding FTX Founder Sam Bankman-Fried | ||||

| 29.03.2024 | 18:30 | USD | Statements by US Federal Reserve Secretary Powell | ||

| 29.03.2024 | USD | US Stock Markets Closed for Good Friday |

Last week, the Fed announced its interest rate decision for March. The Fed kept the interest rate steady at 5.50%. Thus, there has been no change in the interest rate in five consecutive meetings, and it continued to signal three interest rate cuts by the end of 2024. Fed Chairman Jerome Powell said, ‘Supply and demand are coming into better balance. With this rebalancing, we expect the contribution to inflation to come down.

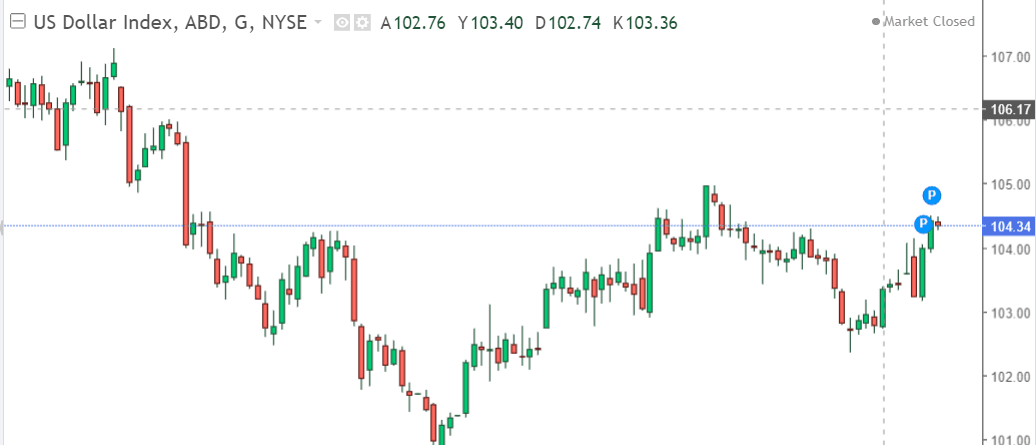

Today, as the week begins, the Dollar Index (DXY) is trading around 104 levels.

-The Central Bank of the Republic of Turkey (CBRT) Announced Its Interest Rate Decision

Last week, the Central Bank of the Republic of Turkey announced its interest rate decision. In March, the policy rate was unexpectedly raised from 45% to 50%. According to a survey conducted by the Central Bank, the year-end inflation expectation increased from 42.96% to 44.19%. The USD/TRY expectation also rose from 40.02 to 40.53. While participants’ year-end exchange rate expectation was 40.02 TL, their exchange rate expectation for 12 months ahead increased from 41.15 TL to 42.79 TL. The year-end current account deficit expectation decreased from 34.6 billion dollars in the previous survey to 33.3 billion dollars in this period.

-Will Ethereum Be Classified as a Security?

According to CoinDesk’s latest report, the U.S. Securities and Exchange Commission (SEC) is reportedly working on classifying Ethereum as a security. If this happens, it could have significant implications across the crypto market, including spot Ethereum ETFs.

-Is ADA Leading on GitHub?

ADA continues to be among the leading Layer 1 blockchain protocols by actively maintaining development activities on GitHub. According to IntoTheBlock data, ADA (Cardano) is ahead of other major protocols like Ethereum, Avalanche, Litecoin, and Tron. Between March 11-17, ADA surpassed its closest competitor, Ethereum, with 978,780 commits.

BTC:

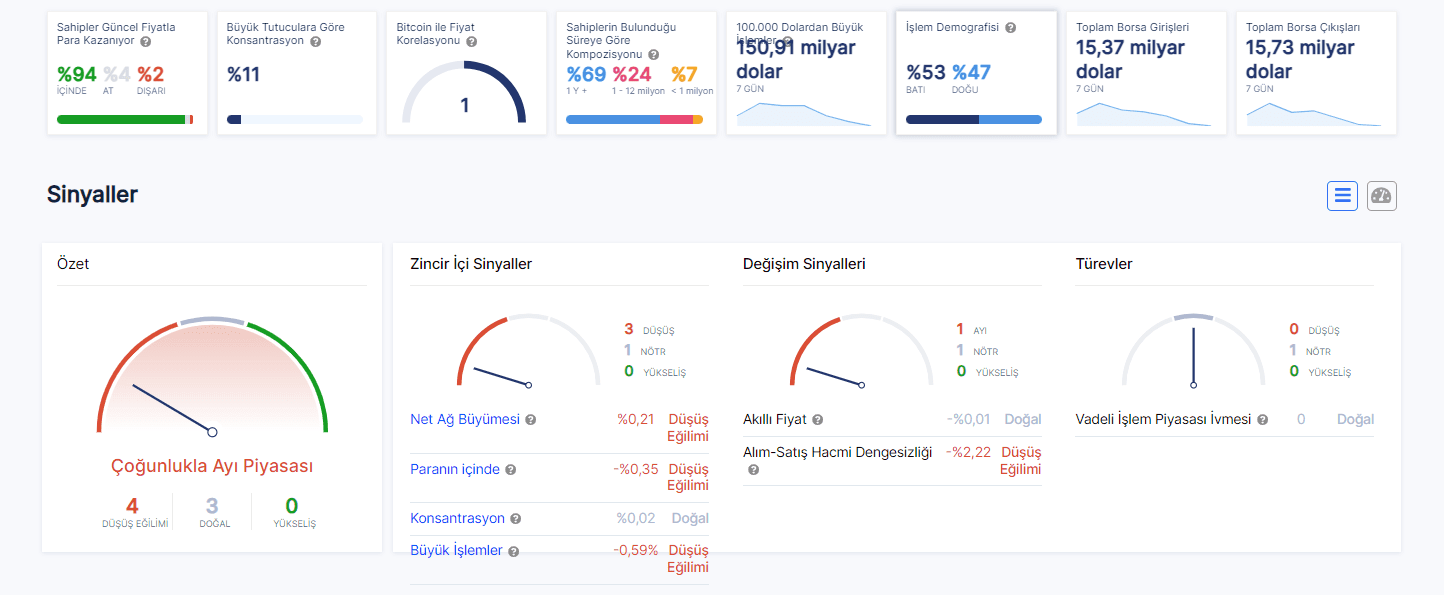

After reaching its All-Time High (ATH), Bitcoin’s slight pullback has confused investors. With the Halving approaching, uncertainty continues regarding its price. From a technical perspective, evaluating with the ITB analyses on our EgeMoney website.

Last week, we saw the percentage of Bitcoin holders in profit at around 96%. This week, we observe that this percentage has decreased to 94%. We mentioned last week that there could be a shift from Bitcoin to altcoins. It seems that miners are selling off to upgrade their BTC production lines. Additionally, profit-taking is observed in some small ETFs. Generally, there may be such a mixed outlook in the markets before the Halving. Currently, it’s making a sawtooth movement, and to avoid being caught on the wrong side when it decides on a direction, we can use ‘Take Profit’ and ‘Stop Loss’ orders in our transactions.

The investment information and comments included in this research report are not investment advice.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.