Economic Expectations for the Week:

| Date | Time | Currency | Event | Expectation | Previous Data |

|---|---|---|---|---|---|

| October 28, Monday | 12:30 | TRY | Turkey – Republic Day – Early market closure at 12:30 PM | ||

| October 29, Tuesday | TRY | Turkey – Republic Day Holiday | |||

| October 30, Wednesday | 15:15 | USD | ADP Non-Farm Employment Change | 143K | |

| October 31, Thursday | 13:00 | EUR | Eurozone Consumer Price Index (CPI) (YoY) | %1.7 | |

| October 31, Thursday | 13:00 | EUR | Eurozone Unemployment Rate | %6.4 | |

| November 1, Friday | 15:30 | USD | Non-Farm Payrolls | 140K | 254K |

| November 1, Friday | 15:30 | USD | Average Hourly Earnings (MoM) (Oct) | %0.3 | %0.4 |

| November 1, Friday | 15:30 | USD | Unemployment Rate (Oct) | %4.1 | %4.1 |

Global Markets Highlight the Weakening of the Japanese Yen:

In Japan, the ruling Liberal Democratic Party (LDP) and its coalition partner Komeito lost their majority in parliament following the weekend elections. LDP and Komeito secured only 215 seats, falling short of the 233-seat majority threshold. As a result, the Japanese yen weakened against the dollar, dropping by 0.9% to 153.88, the lowest level in the past three months.

Individual Investor Interest in Spot Bitcoin ETFs

According to Binance’s latest report, 80% of the assets under management (AUM) in spot Bitcoin ETFs belong to individual investors. These ETFs, launched in January 2024, are considered a major milestone in the crypto market, attracting a total net inflow of $21.6 billion to date. Binance analysts note that this influx is largely a shift of existing assets by individual investors into ETFs offering regulatory protection, rather than new investments.

While institutional interest—especially from investment advisors and hedge funds—is growing, caution still prevails in this sector. Leading investment firms like Vanguard continue to maintain a cautious stance on investing in Bitcoin and crypto ETFs.

In recent weeks, there has been significant interest in spot Bitcoin ETFs, with $2.88 billion invested between October 11-23. However, some analysts warn that this surge could lead to short-term fluctuations in Bitcoin’s price.

Bitcoin Whales Are Setting Records

Bitcoin is back in the spotlight due to the rapid accumulation by whales. The number of whales has reached its highest level since January 2021, now standing at 1,678. This development boosts confidence in Bitcoin’s long-term price potential, painting an optimistic picture for investors. Large players accumulating more Bitcoin is typically seen as a signal of a forthcoming price increase. Continued accumulation by whales suggests that they expect Bitcoin’s price to rise significantly in the future, signaling an important opportunity for new investors.

Bitcoin is currently trading around $67,000, but large investors are expecting even higher prices. Interest in spot Bitcoin ETFs listed in the U.S. is also driving this whale accumulation. Spot ETFs attract investors by providing regulatory protection and transparency, which is one of the key factors pushing Bitcoin’s price upward.

Year-End Bitcoin Price Predictions: $80,000 – $100,000

Most analysts forecast that Bitcoin’s price could reach between $80,000 and $100,000 by the end of the year. Whale accumulation and demand for ETFs are the primary factors supporting these predictions. As markets approach the year-end, a rally is expected, and Bitcoin seems poised to meet these targets.

Record Activity in Bitcoin Options Ahead of U.S. Elections

The upcoming U.S. elections have caused a surge in activity in the Bitcoin options market. Investors expect Bitcoin’s price to rise regardless of the election outcome. There is strong anticipation in the options market that Bitcoin could reach $80,000 by the end of November. Post-election uncertainties and global economic fluctuations are believed to drive further demand for Bitcoin. If everything goes as expected, Bitcoin could even approach $100,000 by the end of the year. Currently, there is a record number of positions in Bitcoin options, signaling exciting days ahead for the cryptocurrency.

BTC:

Could Bitcoin Reach $80,000 in October?

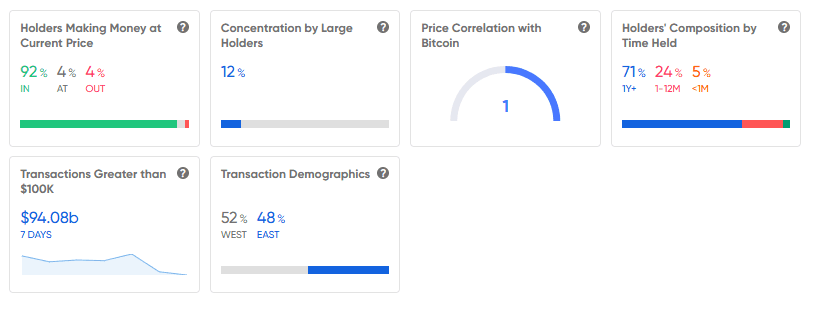

Let’s explore this question with ITB analyses. With 92% of investors currently in profit, the trend of gains in the Bitcoin market appears to be continuing. However, this figure was at 95% last week. Only 4% of investors are in loss, creating a positive market sentiment. Whales exert a 12% influence in the market. 71% of investors hold their assets for more than one year, 24% hold them for 1-12 months, and only 5% hold for less than one month. This shows that the majority of investors are long-term holders, demonstrating confidence in the asset. Last week, the percentage of short-term holders (less than a month) was at 6%, but it has now dropped to 5%. This indicates growing long-term confidence in Bitcoin.

In the short term, the upcoming U.S. elections (November 5) could increase market volatility. Therefore, the $70,000 level is a key psychological threshold to watch. If Bitcoin breaks above this level, it could lead to a surge in buying activity.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.