The billionaire, known for his support of the cryptocurrency industry, will assume his new position on September 10, 2023.

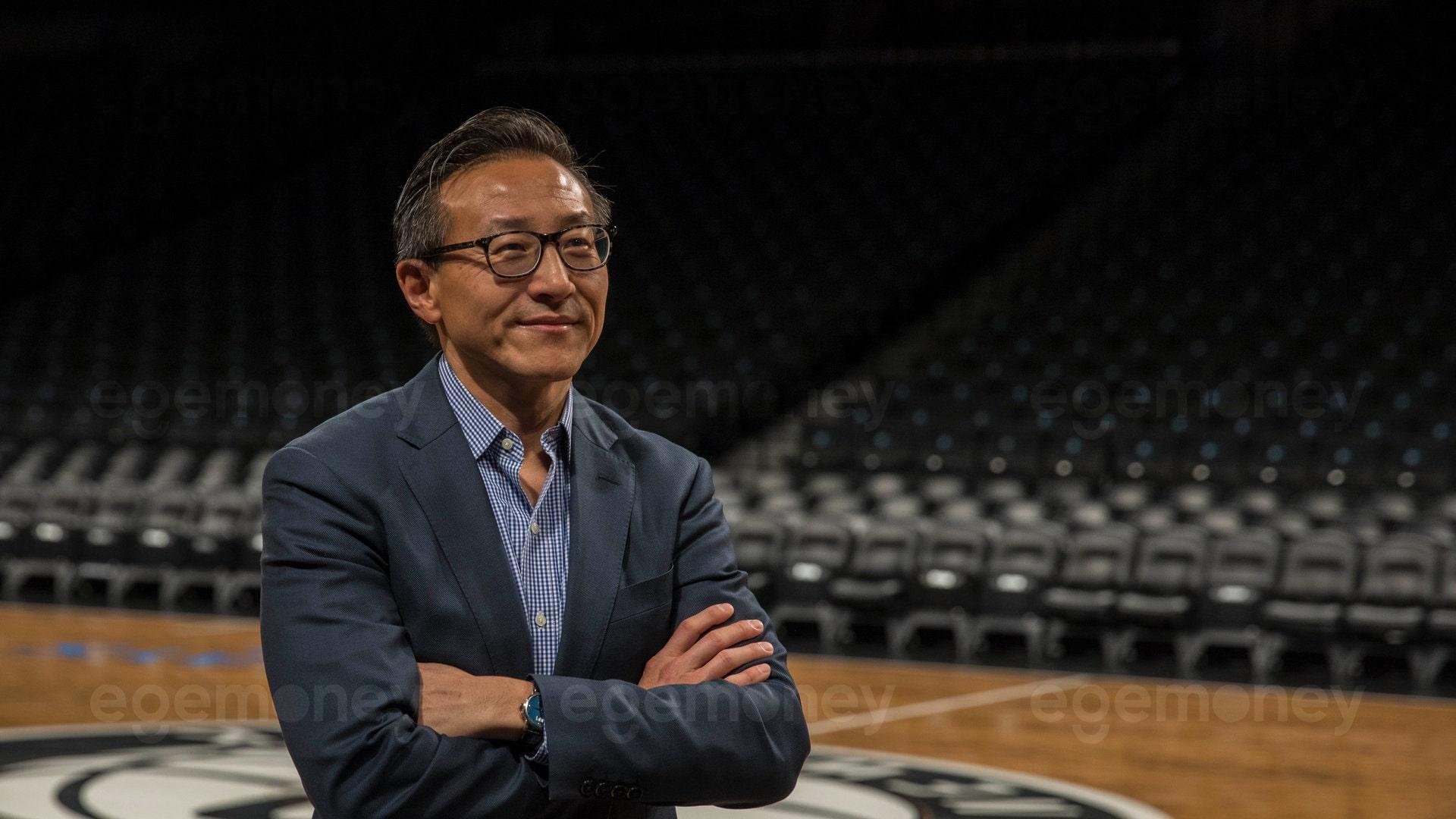

Alibaba Group, the Chinese technology company specializing in e-commerce, announced that Joseph Tsai will replace Daniel Zhang as the company’s new Chairman.

The Taiwanese-Canadian billionaire businessman is recognized as a proponent of the cryptocurrency sector and has been associated with several digital asset projects. Recent sources have revealed that Blue Pool Capital, the organization managing Tsai’s personal wealth, participated in two funding rounds of the once-prominent cryptocurrency exchange FTX.

Changes in Leadership

Tsai, currently serving as Executive Vice Chairman, will assume his new role on September 10, replacing Daniel Zhang. Eddie Yongming Wu, on the other hand, will become the Chief Executive Officer of Alibaba Group and take Zhang’s place on the Board of Directors.

Zhang will continue to lead Alibaba Cloud Intelligence Group and has expressed his commitment to making cloud computing and artificial intelligence services more accessible to businesses of all sizes and industries as they continue their digital transformation.

Tsai highlighted Wu’s previous work as the Chief Technology Officer of Taobao and Alipay, stating that he played a crucial role in shaping their technology platforms and strategic direction. Tsai expressed hope that Alibaba can continue to grow under the new leadership by focusing on technology and innovation.

Tsai’s Crypto Stance

The Taiwanese-Canadian businessman, with an estimated net worth of nearly $8 billion, has displayed a positive vision of the digital asset sector over the years. Some of his initial comments came at the end of 2021 when he simply tweeted, “I like crypto.”

His name was once again linked to the industry in February 2022 when Blue Pool Capital, the organization employed as his family office, participated in Polygon (MATIC)’s $450 million funding round. The company also led fundraising efforts for Artifact Labs in March of this year.

However, not all of his investments in the field have been successful. The South China Morning Post revealed earlier this year that Blue Pool Capital had taken equity positions in FTX during two funding rounds.

Recall that the exchange filed for bankruptcy in November 2022, marking one of the largest collapses in the history of cryptocurrency.