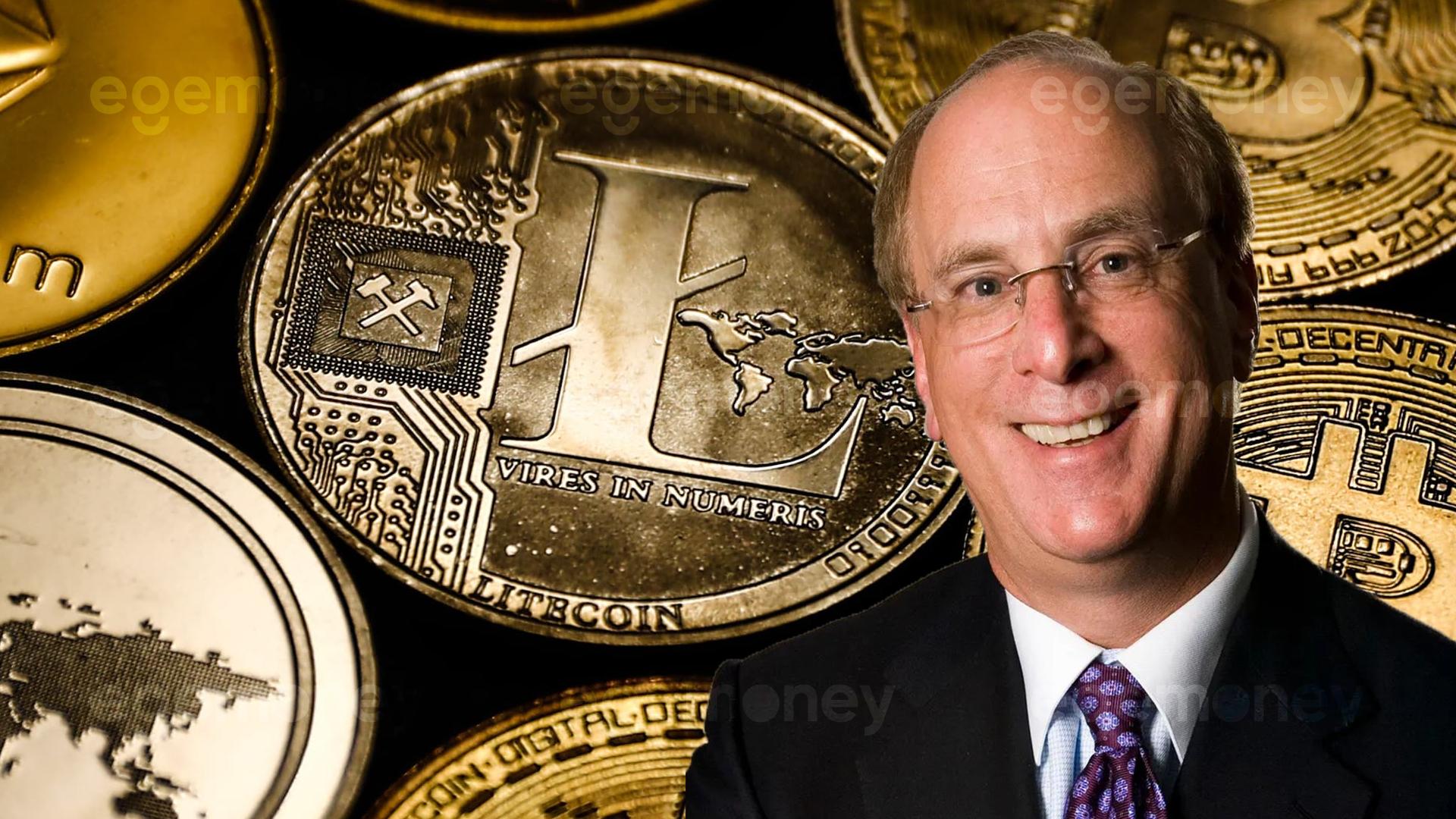

Five years ago, Larry Fink stated that they would not get into the cryptocurrency business until it became ‘legitimate’; Bitcoin ETF applications are questioning whether the world’s largest asset manager has crossed that threshold.

In an interview with Fox Business today, BlackRock CEO Larry Fink referred to cryptocurrencies, especially Bitcoin, as ‘digitizing gold’ and praised Bitcoin as an ‘international asset’.

Fink went on to say:

“Bitcoin is not based on any one currency, and so it can represent an asset that people can play as an alternative. It’s digitalizing gold in many ways. Instead of investing in gold as a hedge against the onerous problems of any one country or the devaluation of your currency of whatever country you’re in, Bitcoin is an international asset.”

This perspective contradicts Fink’s comments at the New York Times Dealbook Conference in 2018. At that time, he expressed caution about the cryptocurrency sector, stating that it would take time for BlackRock to become “valid” for trading crypto assets or launching crypto-based ETFs. Fink also expressed concerns about the unregulated and unsupported nature of crypto assets at that time, suggesting that BlackRock would need government backing to enter this space.

Fast forward to today, and BlackRock sees itself as a pioneer in synthesizing traditional financial markets with crypto markets. In June, the company filed plans with the U.S. Securities and Exchange Commission (SEC) through its subsidiary iShares to create a spot Bitcoin ETF. This application signifies a significant shift in the financial market as a spot Bitcoin ETF has not been approved by the SEC so far due to concerns over market manipulation and lack of regulation in cryptocurrency exchanges. Despite these challenges, BlackRock’s move triggered a wave of institutional interest, as revealed by a survey conducted by Laser Digital, where 96% of professional investors expressed a willingness to invest in crypto. Fink’s recent comments and BlackRock’s ongoing efforts indicate an increasing acceptance of cryptocurrencies within the financial sector.

Amidst the uncertain path to SEC approval for a spot Bitcoin ETF, Fink’s change in perspective from five years ago highlights the rapid evolution of the cryptocurrency world. His current remarks reflect the potential of Bitcoin as an international asset not tied to any specific country and its potential to be used as an investment vehicle in a better future. The question arises whether BlackRock’s recent moves indicate an acceptance of cryptocurrency as ‘valid’ now.