Weekly Economic Expectations:

| Date | Time | Currency | Event | Expectation | Previous Month Data |

|---|---|---|---|---|---|

| January 1, Wednesday | – | – | New Year’s Day – Markets Closed | – | – |

| January 3, Friday | 10:00 | TRY | Annual CPI (Consumer Price Index) (December) | 45.20% | 47.09% |

| January 3, Friday | 10:00 | TRY | Monthly CPI (Consumer Price Index) (December) | 1.61% | 2.24% |

Decline in Trading Volume in the Crypto Market at the End of 2024

As we approach the final days of 2024, a noticeable decline in trading volumes is observed in the cryptocurrency market. According to Santiment data, the trading volume over the past week has decreased by 64% compared to the previous week. This decline has led to the lowest trading levels in many altcoin sectors over the past seven weeks. Santiment explains that this is not surprising due to the impact of the year-end holidays, where investors tend to focus on their personal finances, causing a decrease in market activity. The last week of December is typically one of the periods with the lowest trading volumes of the year.

Ukraine’s Sanctions Package Plan

Ukraine announced it is working on a new sanctions package to prevent Russia from continuing to use Bitcoin and other cryptocurrencies to bypass Western sanctions. Ukrainian President’s Adviser Vladyslav Vlasiuk stated that Russia has been attempting to use cryptocurrencies in international trade to evade sanctions, and that this concern has been communicated to global partners. Additionally, Ukraine is accelerating its efforts to take preventive steps against these threats. It is reported that Russia continues trading with countries like China via stablecoins like Tether, though the exact volume of these activities remains unclear. Russian Finance Minister Anton Siluanov has confirmed that some companies are conducting international trade using cryptocurrencies. It is also known that the Kremlin has developed comprehensive legal regulations concerning Bitcoin mining and the use of cryptocurrencies by certain companies. The use of cryptocurrencies as a trade tool by Russia complicates financial regulations in international relations and holds the potential to greatly impact the future of global trade.

XRP’s Bullish Potential

Expert Armando Pantoja urges investors to focus on the potential of XRP, emphasizing that a strong price increase may occur in the near future. Pantoja highlights key factors, including the outcome of the SEC lawsuit, political developments in the U.S., and general market conditions, as important drivers of XRP’s future. He encourages investors to set aside doubts about XRP and trust more in the asset’s potential. Pantoja believes that after XRP’s impressive 284% rally in November, it could see similar momentum in the near future. Currently, due to market consolidation, XRP is entering a period of stagnation. However, a significant increase in its reserves is also observed. According to Binance data, XRP reserves rose from 2.79 billion tokens to 2.93 billion tokens as of December 16. This increase is interpreted as a sign that some investors may be preparing to sell.

Solana Falling Behind

Solana is experiencing a loss of momentum, underperforming compared to Bitcoin and Ethereum, based on rapidly changing market metrics. According to Glassnode data, the monthly changes in realized capital values for Bitcoin, Ethereum, and Solana have stood out. These ratios provide important indicators for assessing the speed and direction of capital flows in and out of the respective assets.

Analysts suggest that this pullback could represent a last buying opportunity for Solana in light of a potential bull market. The data indicates that Bitcoin continues to lead the market, Ethereum has shown a moderate increase, while Solana has performed weaker. This trend signals a decline for Solana, one that investors should monitor closely.

BTC:

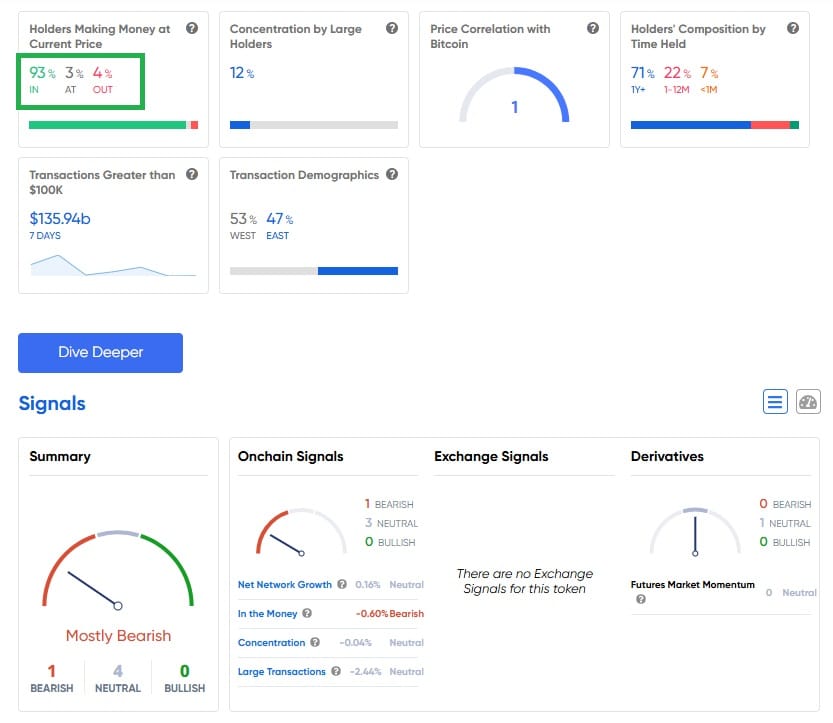

Bitcoin investors were reported to have made significant gains last week, with a profit rate of 93% during that period. However, the situation has now shown a significant shift. Current data reveals that 93% of Bitcoin investors are in profit, 3% are in loss, and 4% are in a neutral position. Whale trading volume, on the other hand, stands at approximately $131.97 billion. This high trading volume reflects the influence of large investors on the market and indicates the intensity of market liquidity. Especially given the significant impact whale movements have on the market, these levels become an important indicator to monitor closely. According to ITB analyses, the Bitcoin market currently has expectations of “4 neutral,” “0 bullish,” and “1 bearish” market conditions. These data suggest that the market is currently balanced, and investors are generally operating in an uncertain environment. “Neutral” positions indicate that no strong trend has emerged in the market, with investors adopting a wait-and-see strategy, while the “bearish” market expectation implies a small potential for a decline. In conclusion, the Bitcoin market is currently going through a stagnant and uncertain period. Investors should focus on observing the market’s balance and trade cautiously, rather than expecting significant upward or downward movements.

“Investment information and comments in this research report are not intended as investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.

- Gizem Günayhttps://blog.egemoney.com/en/author/gizemgunay/

- Gizem Günayhttps://blog.egemoney.com/en/author/gizemgunay/

- Gizem Günayhttps://blog.egemoney.com/en/author/gizemgunay/

- Gizem Günayhttps://blog.egemoney.com/en/author/gizemgunay/