Economic Calendar of the Week:

| Date | Time | Currency | Event | Expectation | Previous Month Data |

|---|---|---|---|---|---|

| 12 August Monday | BTC | US Presidential Candidate Donald Trump meets with Elon Musk | |||

| 14 August Wednesday | 15:30 | USD | US Consumer Price Index (CPI) (YoY) (Jul) | 3.0% | 3.0% |

| 16 August Friday | End of voting for the FTX repayment process |

Russian President Vladimir Putin has enacted a regulation that officially approves cryptocurrency mining in the country. According to this new regulation, starting from November, individuals and companies authorized by the government will be permitted to conduct cryptocurrency mining, provided they remain within the designated energy consumption limits. The Central Bank of Russia had recommended a complete ban on cryptocurrencies in 2021. However, after Russian banks were removed from the SWIFT payment system following the Ukraine war, the use of cryptocurrencies in the country increased significantly. This newly accepted law is more flexible compared to previous bills that proposed bans on cryptocurrencies and presents a more favorable stance towards cryptocurrencies.

-Hong Kong’s Mox Starts Trading Crypto ETFs

Hong Kong-based virtual bank Mox, after recently launching the Mox Invest platform, started offering cryptocurrency ETF services to its customers last week. Mox, a subsidiary of Standard Chartered, stands out as the first virtual bank to offer direct trading of the spot Bitcoin and Ethereum ETFs launched earlier this year in Hong Kong.

-Critical Victory in the Ripple Case

The lawsuit filed by the U.S. Securities and Exchange Commission (SEC) against Ripple had become a significant event representing the tension between regulators and companies in the crypto world. As a result of the SEC’s allegations, XRP experienced a significant drop in value and was under pressure throughout the trial process. However, the recent decision by Judge Analisa Torres concluded in favor of Ripple, stating that Ripple’s XRP sales were not considered an investment contract. This decision marked a turning point for XRP, and following the ruling, XRP’s value quickly increased by more than 20%.

-Adidas and Doodles: A Special Collection Where NFTs Meet Physical Products

Innovative sportswear brand Adidas has partnered with the Ethereum-based NFT collection Doodles to launch a new virtual collection series, along with a limited number of physical products linked to this collection. In an announcement on Twitter, Adidas stated that this special collection would be on sale until August 16. This collaboration between the NFT world and sportswear aims to offer a unique experience to those interested in digital collectibles, both in the virtual and real worlds.

-Trump Jr. Takes on Banking Inequalities with DeFi

Donald John Trump Jr., the eldest son of U.S. presidential candidate Donald Trump, announced plans to develop a decentralized finance (DeFi) platform aimed at addressing perceived inequalities in the banking system. Speaking during a Q&A session on the subscription-based Locals platform on August 8, Trump Jr. mentioned that the project is currently in its early stages. He emphasized that this platform is intended to be a comprehensive initiative challenging traditional financial systems, rather than just creating another memecoin. Trump Jr. stated that the platform aims to address injustices in the banking system, but he did not provide detailed information or a timeline at this time. “We want to penetrate a large part of the financial sector. I just think there’s too much inequality in access to finance for certain people,” he said. He also highlighted that decentralized finance could be an attractive option, especially for those whose accounts have been closed or who have struggled within the financial system. His post on X further fueled speculation, where he stated, “We’re going to shake up the crypto world with a big move. The future is in distributed currency; don’t get left behind.” His brother, Eric Trump, also shared his excitement with a similar tweet, hinting at a significant announcement in the Bitcoin and DeFi space.

-Unemployment in Turkey Hits an 11-Month High

The unemployment rate rose to 9.2% in June 2024, reaching the highest level in 11 months. According to the results of TÜİK’s Household Labor Force Survey, the number of unemployed increased by 234,000 compared to the previous month, reaching 3.305 million. This situation caused a 0.7 percentage point increase in the unemployment rate. The unemployment rate was estimated at 7.6% for men and 12.4% for women.

-New Phase in the Russia-Ukraine War

Ukrainian President Zelensky confirmed that the Ukrainian army conducted a cross-border attack in Russia’s western Kursk region. As the conflicts in Kursk approach the nuclear power plant, the International Atomic Energy Agency (IAEA) under the United Nations (UN) warned both sides to be cautious to avoid a nuclear accident.

-BTC:

A rise from $48,000 to over $60,000 had occurred, but it was not sustained. Currently, it is trading around $58,000.

If we evaluate Bitcoin using the ITB analysis on our EgeMoney website:

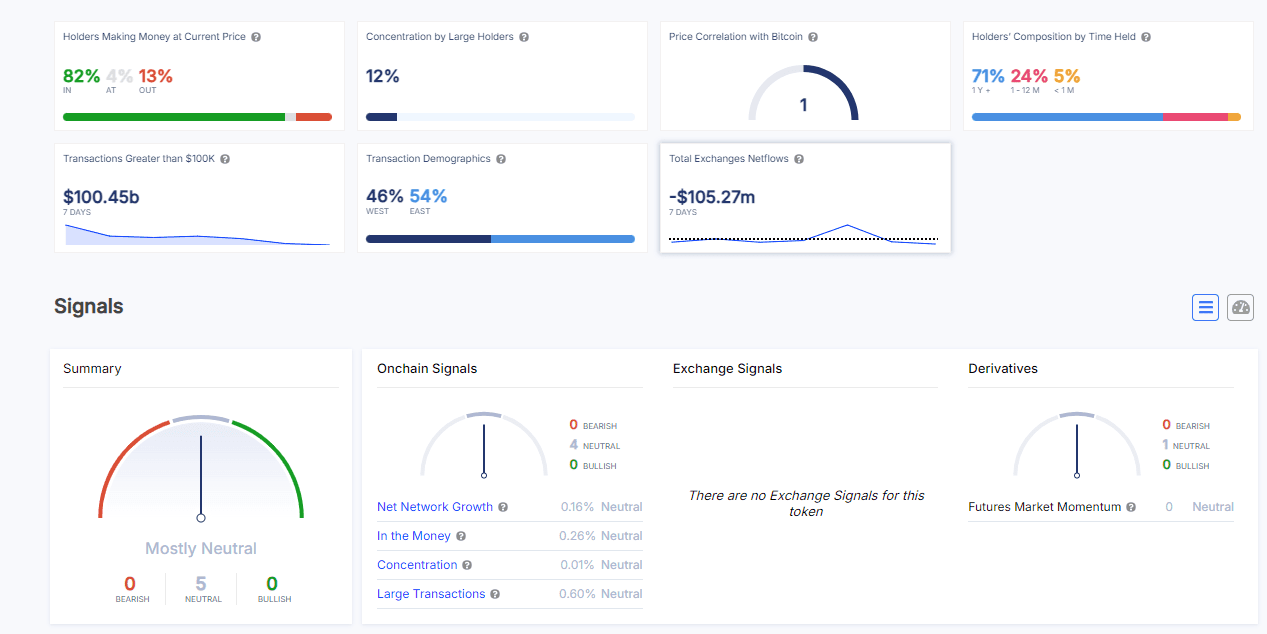

- The percentage of profitable investments has increased from 75% to 82%, while those in loss have decreased from 18% to 13%.

- For transactions exceeding $100,000, there is a decline to $100.45 billion.

- The demographics of transactions are as follows:

%46 ➡ western trading hours (This time frame refers to the period when investors in the Western Hemisphere, such as America and Europe, are actively trading.)

%54 ➡ eastern trading hours (This time frame refers to the period when investors in the Eastern Hemisphere, such as Asia and Australia, are actively trading.)

Additionally, ITB analysis currently indicates 0 “bear,” 5 “neutral,” and 0 “bull” signals. It is not common to see such a neutral outlook in ITB analyses. We might be entering a week where the markets move within a stable channel. However, it is still worth closely monitoring today’s Trump – Elon Musk meeting.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.