Important Developments of the Week:

| Date | Time | Currency | Event | Expectation | Previous Month Data |

|---|---|---|---|---|---|

| August 20, Tuesday | 14:00 | TRY | Turkey One-Week Repo Rate (Aug) | 50.00% | |

| August 20, Tuesday | 12:00 | AVAX | AVAX Token Unlock | ||

| August 21, Wednesday | 21:00 | USD | FOMC Meeting Minutes | ||

| August 23, Friday | 17:00 | USD | FED Chair Powell’s Speech | ||

| August 24, Saturday | 15:00 | USD | Jackson Hole Symposium |

Tron Surpasses Ethereum in Blockchain Revenue

Tron has increased its blockchain revenue, overtaking Ethereum and strengthening its influence in the sector. Over the last 90 days, Tron generated approximately $435 million in revenue, while Ethereum’s revenue stood at $364 million. On August 15, Tron’s founder Justin Sun announced that Tron’s protocol revenue had surpassed Ethereum’s by 50% in the past month.

Concerns Over Whale Sales as Ethereum Price Rises

While Ethereum’s price has been rising in recent days, significant sales by large investors have raised concerns about potential future price pressure. Whales have sold approximately $60 million worth of ETH, transferring large amounts of ETH to exchanges like Binance and Coinbase. Despite the price increase, trading volume has decreased, and investor sentiment remains mixed, with ongoing discussions about the potential approval of an Ethereum ETF.

Trump Gaining Momentum Against Harris in Polls

As the U.S. presidential election in November approaches, the competition between Donald Trump and Kamala Harris is reflected in the polls. Following Joe Biden’s withdrawal from the race and Kamala Harris’s candidacy announcement, the gap between the two candidates has narrowed significantly, with some polls showing Harris in the lead. According to the crypto asset prediction platform Polymarket, Donald Trump’s chances of winning the election dropped to 44%, but recent momentum has pushed this figure up to 49%.

AVAX Token Unlock Event

Avalanche (AVAX) is set to unlock 9.54 million tokens on August 20, 2024. This unlock is valued at approximately $240 to $273 million and represents around 2.4% of the total circulating supply. A significant portion of these tokens, about 4.5 million AVAX, will be allocated to the team, with the remainder likely going to strategic partners and the Avalanche Foundation. This unlock event is expected to create significant volatility in the AVAX market. We should exercise caution with our AVAX trades on Tuesday and use “Take Profit” and “Stop Loss” orders.

Goldman Sachs Invests in Bitcoin

Following in the footsteps of banking giant Morgan Stanley, it has been revealed that Goldman Sachs has also invested in Bitcoin. According to documents submitted to the U.S. Securities and Exchange Commission (SEC), Goldman Sachs held $418 million worth of Bitcoin on behalf of its clients as of June 30. Sharmin Mossavar-Rahmani, Chief Investment Officer of Goldman Sachs’s asset management unit, previously stated that they do not consider Bitcoin a type of investment and do not believe in crypto. Meanwhile, Morgan Stanley announced that it had invested approximately $188 million in spot Bitcoin ETFs as of the same date. ETF Store President Nate Geraci noted, “It’s clear that spot Bitcoin ETFs are being increasingly adopted by institutions. Institutional investors generally have a very detailed due diligence process, which can slow down the adoption of any investment.” He also commented, “It’s surprising to see institutional investors entering spot Bitcoin ETFs at this pace.”

Bitcoin’s Inactive Periods

According to on-chain data, approximately three-quarters of all circulating Bitcoin has remained inactive for the past six months or longer. Glassnode’s Hodl Wave chart visualizes this by analyzing the duration that Bitcoin has been held in wallets since its last movement. On-chain analyst James Check noted in a post on August 19 that more than 80% of short-term Bitcoin holders are currently at a loss, having purchased their holdings at higher prices than the current spot price.

BTC:

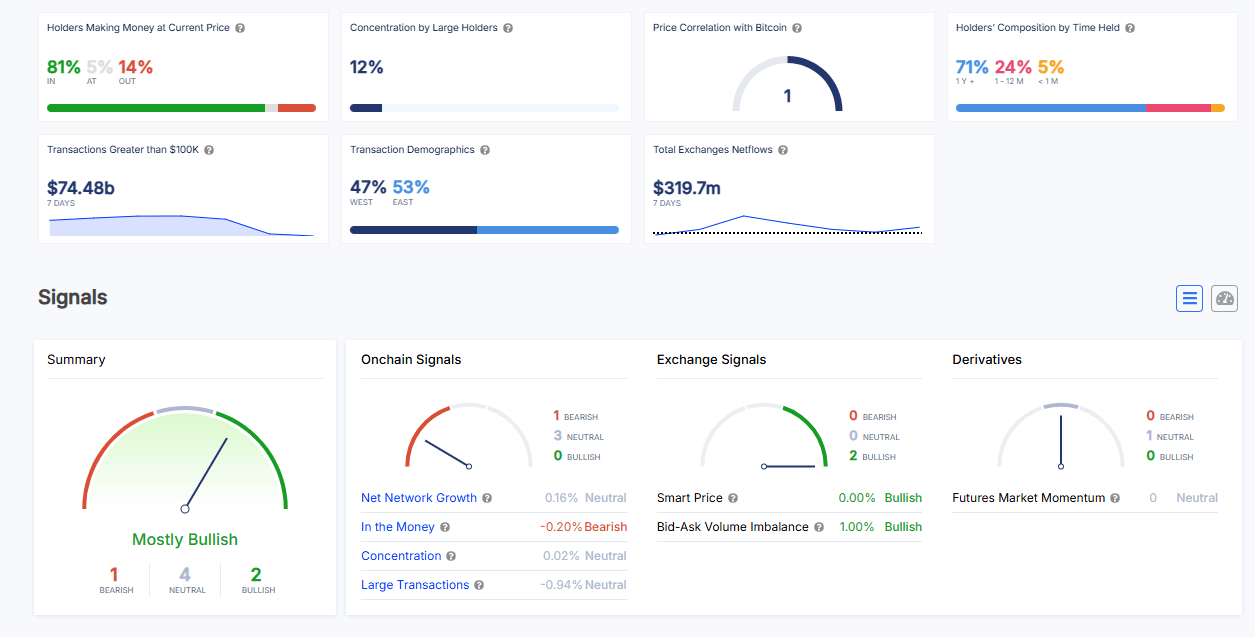

Bitcoin reached a high of $61,500 but failed to maintain this level and is currently trading around $59,000. According to ITB analyses available on our EgeMoney website:

- 81% of investors are currently profitable, while 14% are at a loss. Last week, this ratio was 82% profitable and 13% at a loss, indicating a slightly more optimistic scenario.

- The composition of holders based on the duration they have held Bitcoin is as follows:

- 71% ➡️ 1+ Year

- 24% ➡️ 1-12 Months

- 5% ➡️ <1 Month

This composition has remained stable for weeks.

ITB analyses currently indicate 1 “bearish,” 4 “neutral,” and 2 “bullish” signals.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.