Economic Calendar of the Week

| Tarih | Saat | Döviz | Olay | Beklenti | Önceki Ay Açıklanan Veri |

| 27 May Monday | SOL | Solana 1.18V Update | |||

| 28 May Tuesday | First UK-based Bitcoin and Ethereum ETPs will start trading. | ||||

| 29 May Wednesday | The SEC will decide on options trading for spot Bitcoin ETFs. | ||||

| 29 May Wednesday | BNB Chain Serengeti hardfork will take place. | ||||

| 30 May Thursday | 15:30 | USD | USD US Gross Domestic Product (GDP) | 1,3% | 3,4% |

| 31 May Friday | 10:00 | TRY | Turkey Gross Domestic Product (GDP) | 4,0% | |

| 31 May Friday | ETH, ETC | Ethereum Classic (ETC) halving |

Record of Whales

Bitcoin whales holding for over ten years have set a historic record. According to on-chain analysis platform CryptoQuant’s Head of Research, Julio Moreno, the recent bullish cycle has caused more old whales to move compared to previous bull markets. Moreno noted that these whales set a new record when Bitcoin’s price reached $73,000. Interestingly, these whales were more inclined to buy rather than sell during this period.

Year-End BTC Predictions

Standard Chartered Bank has raised its year-end Bitcoin price forecast to $150,000. This prediction is driven by strong institutional demand for the new spot Bitcoin ETFs launched in the US. The bank believes Bitcoin could reach $250,000 by 2025, supported by increasing adoption and growing interest from institutional investors. Although the $150,000 target appears achievable, the volatile nature of the market must be considered. Numerous variables could impact Bitcoin’s future performance, and investors should carefully evaluate these factors.

Expected Pectra Upgrade for Ethereum

Ethereum core developers plan to release the Pectra upgrade in the first quarter of 2025, as discussed during the execution layer meeting. Following the successful Dencun upgrade in March 2023, Pectra will be the next significant development for Ethereum.

The Pectra upgrade will introduce the Ethereum Virtual Machine Object Format (EOF), featuring around 11 improvement proposals aimed at enhancing EVM code at both Layer-1 and Layer-2 levels. Additionally, it will include EIP-7251, known as the ‘maximum effective balance increase,’ which will raise the amount of ETH individual validators can stake from the current 32 ETH to 2,048 ETH. This change aims to reduce operational complexity by allowing validators to manage fewer but larger stakes.

These innovative improvements in Pectra aim to create a more efficient and scalable structure within the Ethereum ecosystem, offering significant advantages for both developers and users.

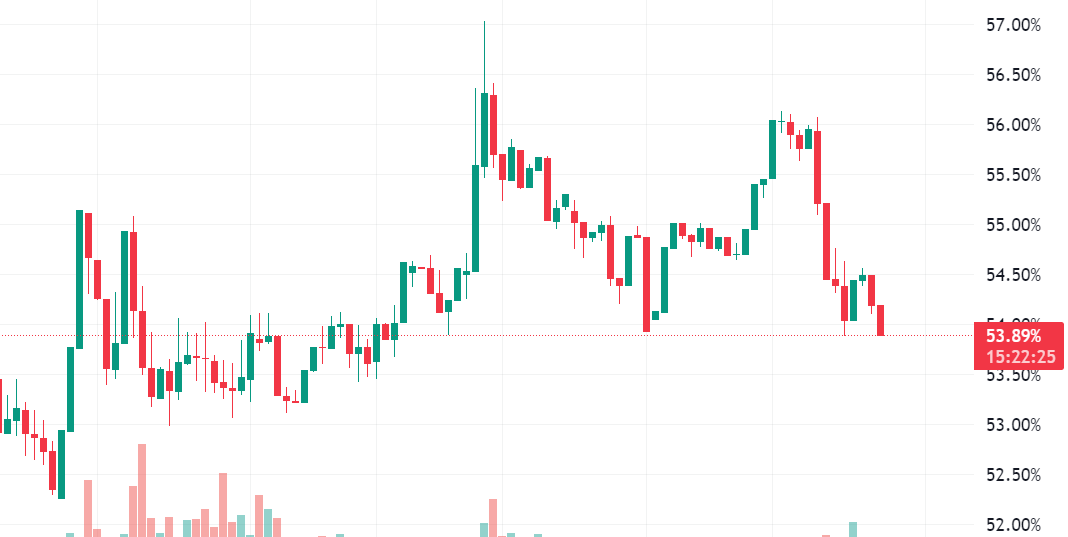

Bitcoin Dominance

Bitcoin dominance is currently at 53.88%. This metric indicates Bitcoin’s market cap relative to the total cryptocurrency market. Bitcoin’s market dominance has risen to this level in recent weeks, typically associated with an increase in Bitcoin’s price.

Rising Bitcoin dominance signals increased investor confidence in Bitcoin and higher demand compared to other cryptocurrencies. Market fluctuations and Bitcoin’s reputation as a “safe haven” may contribute to this dominance. This level of dominance suggests a decrease in the market share of altcoins, with more investors turning to Bitcoin. The future trend of this dominance will depend on the overall market conditions and investor strategies in the coming weeks.

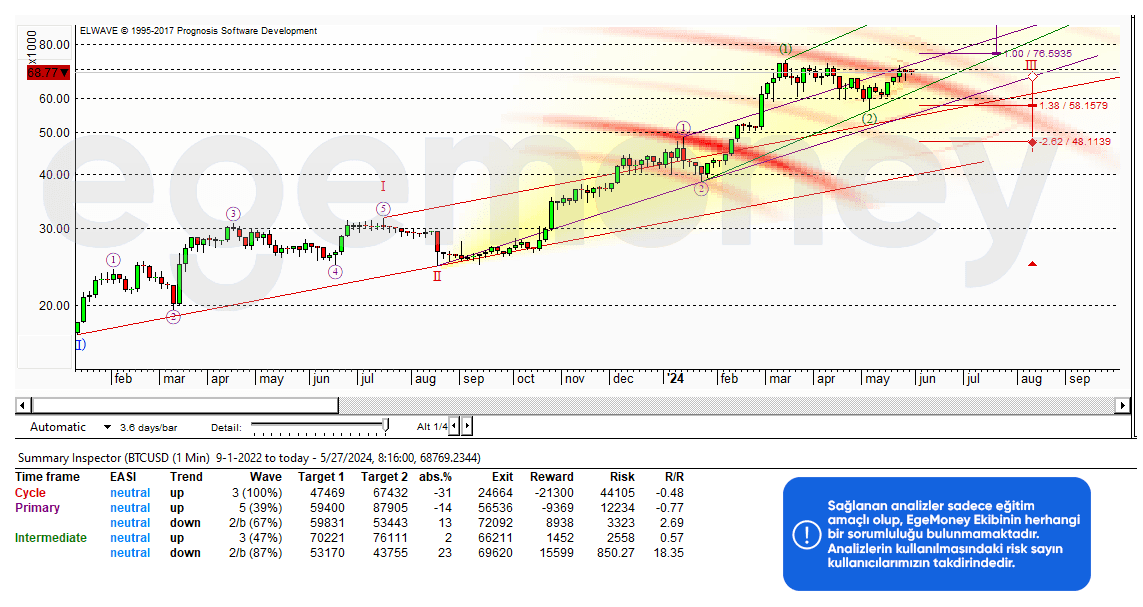

BTC:

According to Elliot Wave Theory, the analysis results indicate an uncertain start in the short term, with targets of 43-50k levels for declines and 70-76k levels for increases. In the long term, positive expectations are increasing. However, the 150k level predicted by Standard Chartered Bank does not seem to be a very near-term target at the moment.

“This research report’s investment information and comments do not constitute investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.