Economic Calendar for This Week:

| Date | Time | Currency | Event | Expectation | Previous Month’s Data |

|---|---|---|---|---|---|

| 24 June Monday | LTC | Litecoin Summit 2024 takes place | |||

| 26 June Wednesday | 17:00 | USD | New Home Sales (May) | 650K | 634K |

| 27 June Thursday | 14:00 | TRY | CBRT interest rate decision | 50% | 50% |

| 27 June Thursday | 15:30 | USD | Gross Domestic Product (GDP) (Q1) | 1.3% | 3.4% |

| 28 June Friday | 18:00 | USD | FED monetary policy report |

Bitcoin miners have sold over 30,000 Bitcoins since the beginning of June as market pressures increase. According to a report by IntoTheBlock, this rate of sales was last seen over a year ago. Miners are experiencing this pressure because their revenues and expenses are breaking even following the Halving that took place in April. After the Halving, the reward miners receive per block was halved, leading to increased sales by miners. As a result, the amount of Bitcoin held by miners has dropped to the lowest level in the last 14 years, decreasing by 50,000 since the beginning of the year. QCP Capital states that miners are facing this selling pressure and that more sales may come. Additionally, the German government sold approximately 3,000 Bitcoins last week, and it is claimed that miners and the German government could sell more than 40,000 Bitcoins in total in the future.

During this process, QCP Capital analysts are focusing on the Ethereum (ETH) market. According to QCP Capital data, there is a heavy purchase of call options for contracts expiring in the September-December period.

SEC NEW DECISIONS

SEC WANTS TO USE RIPPLE DECISION IN BINANCE CASE

The U.S. Securities and Exchange Commission (SEC) has requested the District Court for the District of Columbia to use the decision in the Ripple case as additional authority in the Binance case. The SEC argues that the judge’s opinions in the Ripple case are significant for the lawsuit filed against Binance, Binance.US, and former CEO Changpeng Zhao. California District Court Judge Hamilton ruled in favor of Ripple Labs in the Ripple case, rejecting most of the plaintiffs’ securities violation claims. However, the case regarding CEO Brad Garlinghouse’s misleading statements about XRP sales will continue. Hamilton created controversy by ignoring the SDNY court’s decision that XRP programmatic sales were not securities and suggested that programmatic buyers may have purchased XRP with the expectation of profit from Ripple’s efforts according to the Howey test. The SEC aims to use this California case in its appeal in the Second Circuit, which needs to decide whether XRP sales are securities. The outcomes of these cases will have significant impacts on the cryptocurrency market and shape the future of legal regulations.

Solana has introduced an innovative Zero Knowledge Compression (ZK Compression) feature in collaboration with Light Protocol and Helius Lab. This technology aims to significantly reduce the costs of creating tokens and accounts by compressing on-chain data. This innovation greatly enhances Solana’s scalability while maintaining its security and performance. Helius CEO Mert Mumtaz stated that this feature provides a 10,000-fold improvement in scalability, allowing for service to a larger number of users. Additionally, Solana’s Head of Strategy, Austin Federa, noted that this innovation will result in significant cost savings for businesses, enabling them to reach a broader user base. The ZK Compression feature improves Solana’s existing infrastructure, offering a more efficient and cost-effective blockchain experience. This innovation provides substantial advantages for both individual users and businesses, increasing Solana’s potential for future growth.

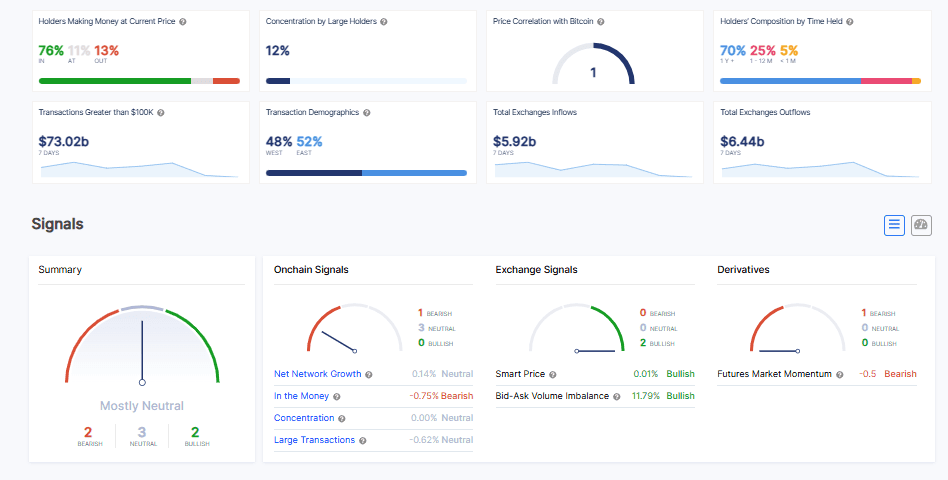

According to ITB analyses, we observe that the profit rate for Bitcoin holders this week is 76%. Total exchange inflows have dropped to $5.92 billion, while total exchange outflows have reached $6.44 billion. This indicates that more Bitcoin is being withdrawn from the market, potentially leading to a decrease in supply. Whale transaction volumes are observed to be $73.02 billion. According to ITB analyses, there are 2 “Bearish,” 2 “Bullish,” and 3 “Neutral” expectations for Bitcoin. The large-volume transactions by whales and the increase in total exchange outflows could have significant impacts on the market this week.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.