What will we encounter in the economic aspect in the first week after the ETF approval?

| Date | Time | Currency | Event | Expectation | Previous Month’s Announced Data |

|---|---|---|---|---|---|

| 17.01.2024 | 13:00 | EUR | EUR Eurozone Consumer Price Index (CPI) (Annual) (Dec) | 2,9% | 2,4% |

| 18.01.2024 | 16:30 | USD | USD Initial Jobless Claims | 207K | 202K |

| 19.01.2024 | 10:00 | TRY | Central Bank of Turkey to update year-end inflation expectations | 65,39% |

- Due to January 15 being Martin Luther King Day, U.S. stock markets will be closed today.

- Last Friday in Turkey, Moody’s confirmed Turkey’s credit rating as “B3”, changing the outlook from “stable” to “positive”.

Already, an increase in the rating was not expected, but an improvement in the outlook was anticipated. As the expectation has been factored in, there might be some selling in BIST this week.

For cryptocurrencies, last week was a turning point; on January 10, the SEC approved 11 spot Bitcoin ETFs. After the approval, Bitcoin fell below the $42,000 support on Friday, nearly losing 10% of its value.

The three most anticipated developments in the cryptocurrency market in 2024 were as follows:

- Spot Bitcoin ETFs

- Bitcoin halving

- U.S. elections

Spot Bitcoin ETFs have been approved. Now, the BTC Halving expected on April 22 and the U.S. presidential elections scheduled for November 5, 2024, will be the eagerly awaited turning points of this year.

BTC:

Following the ETF approval, we can see the continuation of sales in Bitcoin, which has retreated to the 41,500 USDT levels. In the continuation of sales, the 42,000 level maintains its appearance as an important support. If a break occurs, we might observe a sharp movement down to 40,840 USDT. In possible recoveries, 43,500 USDT will retain its importance. With an increase in purchases, we can see the movement continue up to 44,420 USDT. Supported by possible new news flows, 45,600 USDT and 47,180 USDT can be our medium-term target levels.

Evaluation of ITB Analyses

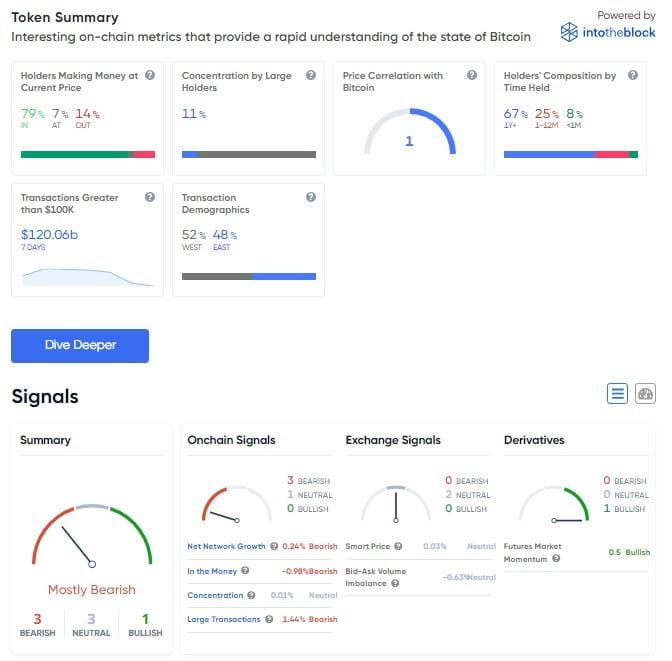

If we examine BTC using ITB analysis;

Last week, it appeared as 85% profitable, 6% neutral, and 9% at a loss, while currently, it stands at 79% profitable, 7% neutral, and 14% at a loss. The increase in the loss percentage is undoubtedly influenced by the ETF approval. We had seen that the whales’ transactions were at $91.14b last week, and this week they are at $120.06b. We can infer that some whales are interpreting the market sell-off as a buying opportunity.

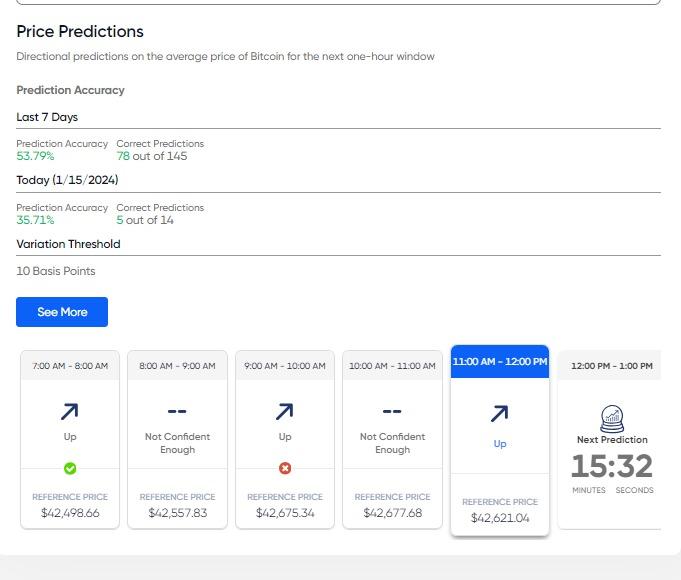

We can get support from the predictions section for the short-term direction. Currently, ITB analyses are predicting an upward trend for the time period we are in. While the accuracy of the forecast is 53% for the past 7 days, today it is at 35%. Therefore, it may be more accurate to draw conclusions by adding our own analyses to ITB’s predictions rather than relying solely on them. Analyzing the data in isolation can often disappoint investors. Hence, it would be best to consider fundamental and technical analysis together.

SOL:

Solana, for weeks, has been a favorite we’ve been following closely, successfully distinguishing itself among altcoins. This week may be more subdued for Solana. We see that it is quite close to support. The 93.90 USDT level requires close monitoring. If it breaks this level, sales could intensify significantly. On the upside, the 109.40 level is also in our sights, with the psychological threshold at 110 USDT. If supported by incoming news, we could observe a move back to the 124 USDT levels in the medium and long term.

“The investment information, opinions, and recommendations contained in this research report are not within the scope of investment advisory.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.