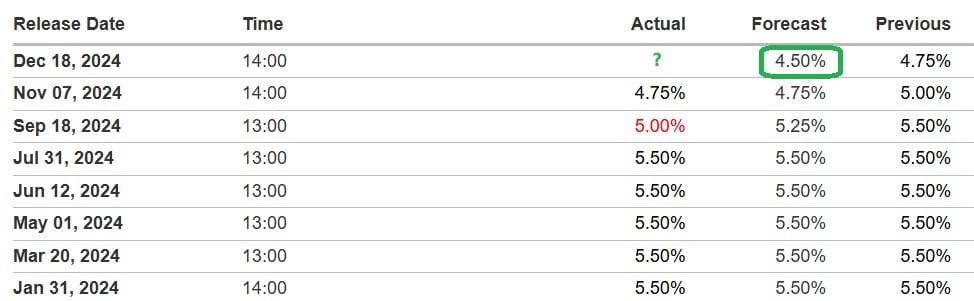

FED Interest Rate Cut Expectations

The most important macroeconomic data of this month is the interest rates that will be announced today in the U.S. We know that the FED sets its interest rate decisions based on economic conditions and inflation rates.

In the U.S., consumer prices in November increased by 0.3% compared to the previous month, and rose by 2.7% year-on-year. After these figures, which are in line with expectations, markets have already started to strongly price in the possibility of a 25 basis point rate cut by the FED.

FED Decisions Since the Beginning of 2024

The amount of interest rate cuts next year is important for us. The market does not expect an interest rate cut in January, and there will be no FOMC meeting in February. The main question is whether there will be a rate cut in March.

From a cryptocurrency perspective, an interest rate cut from the FED could stir the markets. The data, which will be released at 22:00 Turkey time, will be important to follow for the direction of your trades. The statements from FED Chairman Powell at 22:30 will also be guiding for 2025.

“The investment information and comments in this text do not constitute investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.