Cryptocurrency Summit Week Economic Developments:

| Date | Time | Currency | Case | Expectation | Previous Month’s Data |

| May 6 Monday

| XRP | Deadline for SEC’s response regarding the Ripple lawsuit | |||

| May 8 – May 9 | BTC Crypto and Digital Assets Summit | ||||

| May 9 Thursday | 14:00 | GBP | United Kingdom Interest Rate Decision (April) | 5,25% | 5,25% |

| May 9 Thursday | 10:30 | TRY | TRY Central Bank of the Republic of Turkey Inflation Report | ||

| May 9 – May 10 | BTC | BTC Bitcoin Asia Conference in Hong Kong |

Last week, the Federal Reserve (FED) announced its interest rate decision and kept it steady within the expected range of 5.25-5.50%, which is the highest level in 22 years. In the statement from the Fed, it was mentioned that the Federal Open Market Committee (FOMC) targets maximum employment and a long-term inflation rate of 2%, and the decision to keep the federal funds rate in the range of 5.25-5.50% was made to support these targets. Another highlight of last week was the Non-Farm Payrolls data, which turned out worse than expected and caused Bitcoin to rise. With the rise that started when the data was announced, we can currently see Bitcoin attempting to hold above 64,000.

The Solana-based Gameshift platform announced its partnership with Google Cloud.

In a shared post, Solana Labs stated that they initiated the partnership with Google Cloud to offer GameShift to their customers, accelerate the integration of digital gaming assets and user-generated content into Web2 games, and promote the mainstream adoption of blockchain technology in the gaming sector.

Chainlink partnered with Rapid Addition

Chainlink has partnered with Rapid Addition, a FIX connectivity provider, to develop a specialized adapter for institutional digital asset trading on the FIX protocol. This partnership, utilizing Chainlink’s Interoperability Protocol, enables interaction with various tokenized assets, ranging from real estate to renewable energy products, allowing banks and financial institutions to have access to a single source of truth for commercial allocations, reduce error rates, integrate legacy systems, and engage with new blockchain-based asset types.

Ripple entered into a strategic partnership with HashKey DX,

Ripple has entered into a strategic partnership with HashKey DX, a subsidiary of the HashKey Group. The partnership aims to launch XRP Ledger-supported business solutions in the Japanese industry.

Vodafone plans to integrate cryptocurrency wallets with SIM cards to bring smartphone users closer to blockchain technology. This development of Vodafone occurred in the context of an announcement of a financial plan where Vodafone Idea Ltd, serving in India and being a 45% shareholder of Vodafone Group, could obtain approximately $3 billion in debt. David Palmer, Vodafone’s blockchain leader, spoke about the company’s plan for blockchain integration with SIM cards in smartphones on the Yahoo Finance Future Focus program, emphasizing the importance of this integration as the number of smartphones in operation is expected to exceed 20 billion by 2030, most of which will be smartphones.

Recently, Vodafone also announced a 10-year strategic partnership with Microsoft to provide more functional artificial intelligence services to its customers.

BTC:

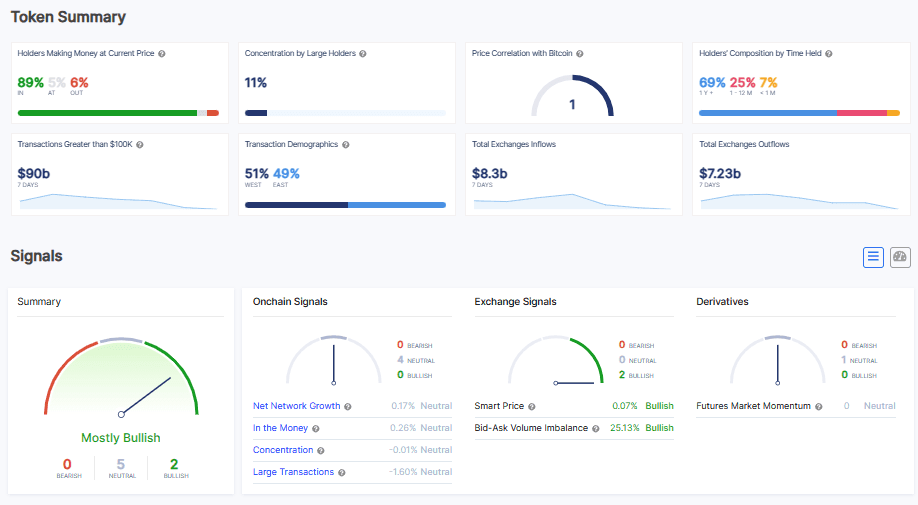

When evaluating expectations for Bitcoin with ITB analyses;

This week, we see that the profit margin for Bitcoin holders has dropped to 89%. While total exchange inflows are above 8 billion, total exchange outflows continue to hover around the 7 billion dollar.

According to ITB analyses, there are 0 ‘Bear’, 2 ‘Bull’, and 5 ‘Neutral’ expectations. In this situation, we can say that Bitcoin has exhibited a more moderate performance last week, likely influenced by the data released.

ETH:

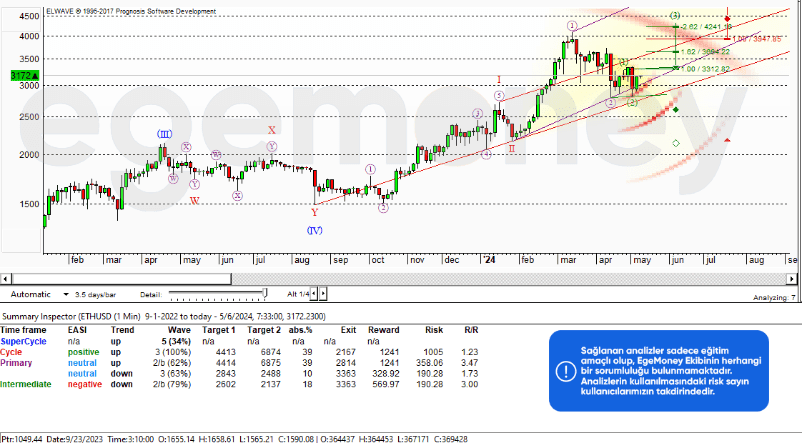

According to the results generated by the Elliott Wave Theory, we encounter a short-term negative outlook that turns positive towards the long term. The most successful transaction signal expected from the 3rd wave aims to surpass $4,000 with a positive expectation in the medium to long term. There are also strong market expectations for Ethereum in the medium to long term. If Ethereum continues to stay strong, we may observe movements above $6,000 in the medium to long term, serving as the 2nd target of the Elliott Wave Theory.

“The investment information and comments included in this research report are not intended as investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.