Weekly Economic Outlook:

| Date | Time | Currency | Event | Expectation | Previous Month Reported Data |

|---|---|---|---|---|---|

| December 16, Monday | AVAX | AVAX, Etna network upgrade | |||

| December 18, Wednesday | 13:00 | EUR | Eurozone – Consumer Price Index (CPI) | 2.3% | 2.3% |

| December 18, Wednesday | 22:00 | USD | Interest Rate Decision | 4.50% | 4.75% |

| December 18, Wednesday | 22:30 | USD | FOMC Press Conference | ||

| December 19, Thursday | 16:30 | USD | US Gross Domestic Product (GDP) | 2.8% | 3% |

| December 20, Friday | 15:00 | ADA | Ada Unlocking begins |

Historical Record in Bitcoin

Bitcoin surpassed the $106,000 mark, reaching its highest value ever and breaking a historic record in the cryptocurrency world. This record shows that Bitcoin’s value is increasing at an accelerating pace and that digital assets are being increasingly accepted. However, this rise is not only driven by economic factors but also by Donald Trump’s election strategies and his interest in cryptocurrencies.

Binance and Circle Partnership

Circle Internet Financial Ltd., the issuer of the stablecoin USDC, and cryptocurrency exchange Binance announced a partnership to expand token usage on their platform as part of their growth acceleration plan. Binance will list more cryptocurrency trading pairs in USDC and offer special promotions related to USDC trades. According to the statement, Binance also plans to hold USDC for its corporate treasury.

Trump’s Reserve Plan Announcement

Donald Trump announced a plan to create a Bitcoin reserve in order to maintain the economic dominance of the U.S. over its global competitors. This announcement generated significant excitement among investors, causing Bitcoin’s value to rapidly increase and set a new record. Trump’s interest in Bitcoin further emphasizes the importance of digital assets in the financial system. Behind this rise is not only Trump’s statements but also the Bitcoin Law introduced by Republican Senator Cynthia Lummis. This law foresees the U.S. government purchasing 1 million Bitcoin over the next five years. This legal regulation paves the way for Bitcoin to be used as a strategic reserve, while aiming to strengthen the economy of the country through digital assets. Other countries are also planning similar steps. For example, Russia’s Finance Minister Anton Tkachev stated that creating a Bitcoin reserve could be useful as a solution against sanctions in their country.

Bitcoin for Portfolio Diversification

One of the world’s largest asset management companies, BlackRock, considers Bitcoin to be a suitable investment vehicle for portfolio diversification. The company recommends investors allocate 2% of their portfolio to Bitcoin for long-term value appreciation and risk management. BlackRock analysts emphasized that due to Bitcoin’s limited supply and increasing institutional acceptance, it has secured a unique place compared to traditional investment vehicles. According to their analysis, Bitcoin offers a significant opportunity for portfolio diversification. The company stated that this strategic allocation could provide investors with the chance to balance their portfolios and potentially generate high returns. For investors, Bitcoin’s unlimited growth potential and risk-reducing advantages make it a notable option for future investment plans. This suggestion regarding Bitcoin investments is likely to attract more institutional investors as digital assets enter the mainstream, further cementing Bitcoin’s role in BlackRock’s portfolio diversification strategies.

FOMC Meeting

Investors are focused on the FOMC meeting scheduled for Wednesday this week. According to data from CME Group’s FedWatch Tool, markets predict there is a 97.1% chance that the Fed will cut interest rates by 25 basis points. This is emerging as a significant development for financial markets. Presto Research analyst Min Jung stated, “The FOMC meeting will provide critical insights into the direction of the Fed’s interest rate reduction policy.” Jung also emphasized that the cryptocurrency markets could be affected not only by the Fed’s decisions but also by developments regarding U.S. President Donald Trump’s inauguration ceremony in January. During this process, the impact of economic and political developments on digital assets and financial markets will be strongly felt.

Critical Unlocking for Cardano Investors: 18 Million ADA Unlocked

An important development is on the way for Cardano (ADA) investors. Next week, 18 million ADA tokens worth 20 million dollars will be unlocked. This process will begin on December 20, 2024, at 3:00 PM, and these tokens will enter circulation on the Cardano network. The amount of ADA being unlocked represents approximately 0.05% of the total supply. This unlocking could lead to price fluctuations. I recommend paying attention to these dates when making ADA transactions.

BTC:

According to ITB analyses;

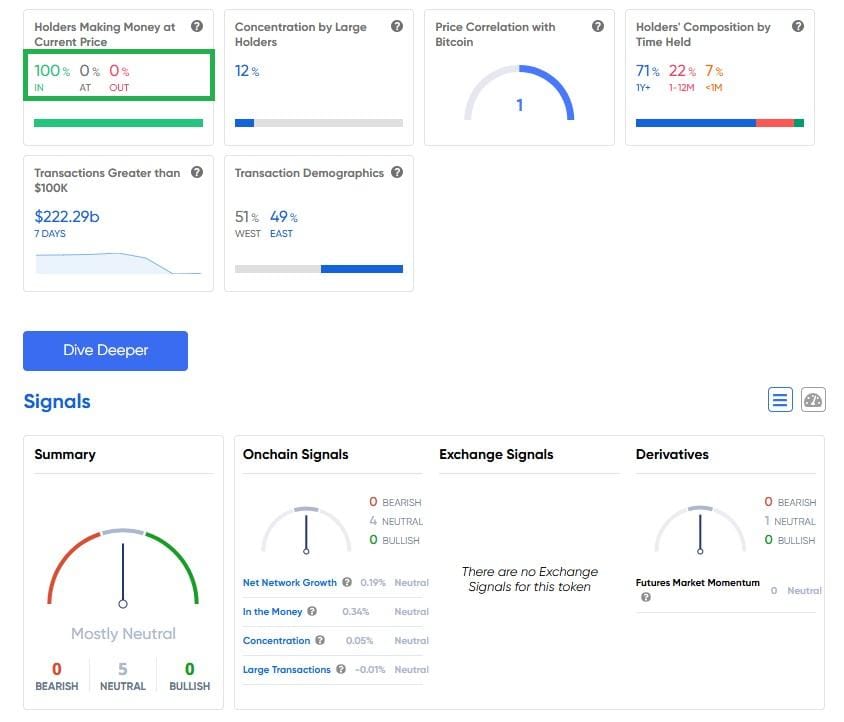

Currently, 100% of Bitcoin investors are in profit. This rate was 98% last week. The percentage of investors at a loss is at 0%, which creates a very positive atmosphere for the market.

Large investors, known as “whales,” have a significant impact on the Bitcoin market. According to ITB data, the trading volumes of the whales have dropped to $222.29 billion. This shows that whales are adopting a more cautious approach in the market and that large trading volumes have decreased.

ITB analyses show a market expectation of 5 neutral, 0 bullish, and 0 bearish for Bitcoin. These data suggest that the market is currently balanced and no major upward or downward movements are expected.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.