Finder’s latest survey conducted with 40 leaders in the crypto sector reveals an optimistic market trend for Bitcoin in the coming 12 months. This panel predicts a significant increase in Bitcoin’s value by 2030.

According to the survey results, Bitcoin could reach $77,423 by the end of 2024, $122,688 in 2025, and $366,935 by 2030. These forecasts show more optimism compared to previous surveys and indicate a strengthening bullish market outlook in the crypto sector.

The experts participating in the survey predict that Bitcoin will reach an average of $77,423 by the end of 2024; however, there is a wide range of predictions. Some experts, like Kadan Stadelmann and Daniel Polotsky, point out that the increasing interest from large companies and institutional investors, the approval of spot ETFs, and the expected halving event will be the main reasons for the increase in Bitcoin‘s value. On the other hand, some panelists like John Hawkins see Bitcoin as a speculative asset that can only achieve temporary gains through new spot ETFs.

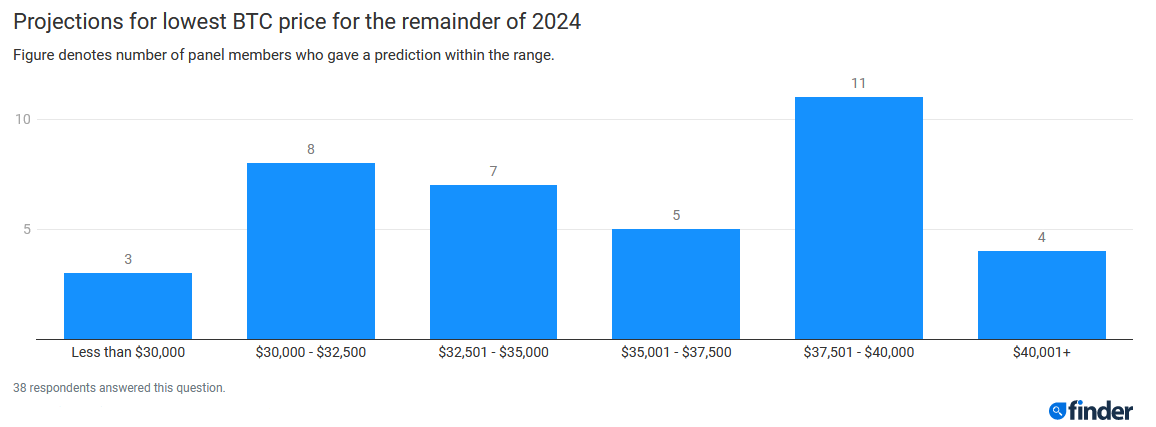

The panel predicts that Bitcoin could rise to as much as $87,875 by the end of 2024, with some estimates going up to $200,000. However, the lowest prediction points to $35,734, and there is a consideration that the price could drop to as low as $20,000. Names like Henry Robinson and Shubham Munde predict that the limited supply and increasing demand will push the price to approximately the $115,000 to $120,000 range.

Source: Finder’s Bitcoin (BTC) Price Prediction Report

Although there are differing opinions on the best path for Bitcoin investors, many experts argue that buying at current prices makes sense. Jason Lau notes that ETF approvals and increased adoption offer a positive long-term outlook for Bitcoin, while Jeremy Cheah suggests caution and expects a modest correction.

Most panelists believe that Bitcoin is currently undervalued, making it an attractive purchase opportunity. Factors such as ETF approvals, halving expectations, and increased institutional investment are seen as the main reasons behind Bitcoin‘s recent price increase. Half of the experts believe that the 2024 halving could initiate the next major crypto bull run, supported by regulatory approvals, macroeconomic factors, and the evolution of market narratives.

The general consensus on the timing for Bitcoin to reach a new peak focuses around October 2024. This reflects a bullish market outlook supported by regulatory developments, market dynamics, and the cyclical nature of Bitcoin‘s halving events.