What Will the Markets Price This Week?

| Date | Time | Currency | Event | Expectation | Previous Data |

|---|---|---|---|---|---|

| July 3, Wednesday | 10:00 | TRY | Turkey Consumer Price Index (CPI) YoY | 75.0% | |

| July 3, Wednesday | 21:00 | USD | FOMC Meeting Minutes | ||

| July 4, Thursday | USD | U.S. Independence Day (markets closed) | |||

| July 4, Thursday | ETH | SEC expected to approve Ethereum ETFs S-1 | |||

| July 5, Friday | 15:30 | USD | Non-Farm Payrolls (Jun) | 189K | 272K |

| July 5, Friday | 15:30 | USD | Average Hourly Earnings (Jun) | 0.3% | 0.4% |

| July 5, Friday | 15:30 | USD | Unemployment Rate (Jun) | 4.0% | 4.0% |

Bolivia’s Crypto Move

The Central Bank of Bolivia has lifted the ban on Bitcoin and other cryptocurrencies, allowing banks to transact with digital assets. This move is part of the country’s efforts to renew its financial system and strengthen its economy.

The Central Bank of Bolivia announced that it has lifted the ban on Bitcoin and other cryptocurrencies and approved regulations that will allow banks to transact with digital assets. This decision aims to modernize Bolivia’s financial system and strengthen its economy. The ban on the use of cryptocurrencies, which had been in effect since 2014, was reinforced by the decree 144/2020 in 2020, completely prohibiting banks from interacting with such assets. However, with the latest regulation, this ban has been lifted, and banks can now conduct cryptocurrency transactions through designated electronic channels.

The Central Bank of Bolivia clarified that cryptocurrencies are not accepted as legal tender. This means that while trading in crypto assets is possible, companies are not obligated to accept such payments.

Bolivia’s new step places the country among the Latin American nations that have embraced cryptocurrencies. The new crypto regulation in Bolivia has been developed in line with the recommendations of the Latin American Financial Action Task Force.

The Central Bank also announced plans to launch an “Economic and Financial Education Plan” aimed at raising public awareness about cryptocurrencies and their proper use. This education plan seeks to inform the public about the potential risks associated with cryptocurrencies and how to manage them responsibly.

Sony’s Crypto Move: Acquisition of Amber Japan

Sony has entered the cryptocurrency sector by acquiring the crypto exchange Amber Japan. This move is part of Sony’s strategy to diversify its financial system and strengthen its economy. Known for its activities in music, gaming, and cameras, Sony has now ventured into the digital asset market with this new initiative. The acquisition of Amber Japan reflects Sony’s aim to establish a broader presence in the technology and finance worlds.

Amber Group and the Cryptocurrency Market

Singapore-based Amber Group acquired Japan’s crypto trading platform DeCurret in early 2022 and rebranded it as Amber Japan. However, following the significant collapse of FTX, Amber Group faced severe financial difficulties and had to undergo a complex debt-to-equity conversion with Fenbushi Capital. Among its prominent investors are major names such as Pantera Capital, Temasek, and Coinbase.

Crypto Developments in Japan

The depreciation of the Japanese Yen has boosted Bitcoin and crypto investments in the country. For example, Metaplanet plans to buy $7 million worth of Bitcoin and is expanding its presence in the crypto market by establishing a new subsidiary. This expansion is seen as an important and major step forward in line with the company’s strategic goals.

The Impact and Future of Sony

Sony’s acquisition of Amber Japan reflects the developments in the Japanese crypto market and the growing interest of traditional companies in this sector. Although Sony’s success in the crypto market is uncertain, it is thought that its strong brand value and technological expertise can be effective in the industry. In addition, this move is being considered as part of Sony’s strategic moves towards digital assets.

-Solana-Based ETFs Poised to Become a New Trend in the U.S. Markets

21Shares, a company that adds a new dimension to crypto investment funds in the U.S., has applied to the SEC for a Solana-based ETF. This development occurred just a day after a similar application from VanEck, intensifying competition in the market.

Investment firm 21Shares has filed for an exchange-traded fund (ETF) based on the Solana blockchain network. This move has created significant excitement in the sector. 21Shares’ application follows a similar initiative from rival firm VanEck, which had recently filed for a Solana-based ETF, drawing considerable attention in the market. Experts believe these successive applications could signal a new era in the sector.

Andrew Jacobson, the company’s legal director, stated, “This step is very important for the crypto industry. We aim to offer American investors new opportunities within the Solana ecosystem.” Jacobson also added that they continue their mission to develop financial products based on cryptocurrencies.

21Shares currently manages $846 million in assets and operates a Bitcoin ETF listed on the Cboe BZX Exchange. According to the company’s official filing, the ETF redemptions will be made in Solana (SOL).

Legal experts have noted that there could be some obstacles for Solana-based ETFs. The absence of a regulated futures market for SOL and the SEC’s previous classification of this asset as a security could complicate the approval process. In response to these comments, Jacobson said, “The inclusion of a cryptocurrency in CME futures contracts is an important example, but it should not be the sole criterion for ETF approval.”

According to the filing, 21Shares will securely store its funds with Coinbase Custody. Industry players and investors are eagerly awaiting the SEC’s response to these applications.

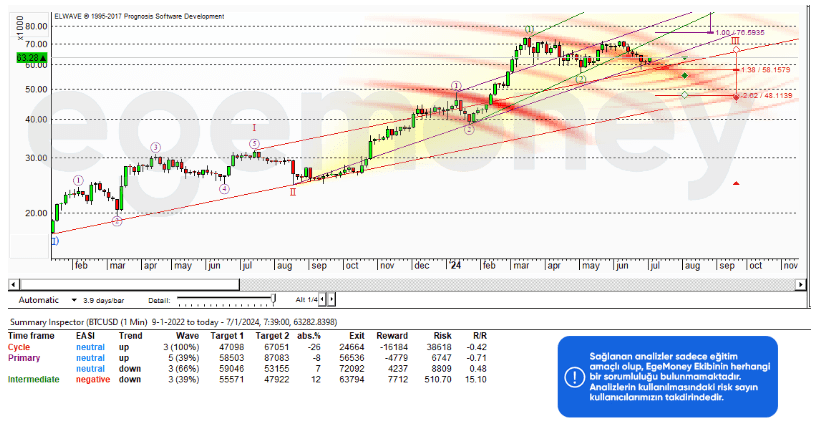

BTC Analysis

According to the Elliott Wave Theory analysis on the EgeMoney website, a short-term downward trend is expected, with potential drops reaching the 55,000 level in conjunction with fundamental data flows. In the long term, the outlook turns neutral.

It will be beneficial for the health of our future transactions to closely monitor several key factors such as ETF approvals, the FED’s stance on interest rates, and the actions of Central Banks regarding cryptocurrencies.

“The investment information and comments contained in this research report are not intended as investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.