Economic Calendar of the Week:

| Date | Time | Currency | Event | Expectation | Previously Announced Data |

|---|---|---|---|---|---|

| October 16, Wednesday | AVAX | AVAX Summit LATAM Event | |||

| October 17, Thursday | 14:00 | TRY | CBRT Interest Rate Decision | 50% | 50% |

| October 17, Thursday | 15:15 | EUR | ECB Interest Rate Decision | 3.40% | 3.65% |

| October 17, Thursday | 15:45 | EUR | ECB Press Conference |

Bitcoin Futures Market Activity

The recent rise in Bitcoin’s price has caused significant volatility in the futures market. Despite many positions being closed, open positions remain at high levels, indicating that investor interest is still strong. According to Glassnode data, approximately $2.5 billion worth of positions were forcibly closed during Bitcoin’s latest rally. This shows that many investors who took short positions have exited the market. However, no reduction above the 5% threshold has been observed in open positions on the top three futures exchanges. This suggests that trading volume and participant activity in the market remain high.

AVAX Buyback

The Avalanche Foundation has reached an agreement with Terraform Labs’ bankruptcy administration to buy back 1.97 million AVAX tokens that were left in limbo following the collapse of the Terra ecosystem. This move was prompted by the collapse of Terra’s ecosystem, which was supported by UST and LUNA tokens, in May 2022. The Luna Foundation Guard, based in Singapore, had purchased $100 million worth of AVAX coins in April 2022 to bolster Terra’s reserves, but Terra’s collapse left the future of these assets uncertain. According to the Avalanche Foundation, this buyback will prevent the Luna Foundation Guard (LFG) from violating token usage restrictions in the original agreement and will protect the tokens from the complications of the bankruptcy process. However, the financial details of the agreement were not disclosed to the public. Currently, the market value of the 1.97 million AVAX is approximately $58 million, reflecting a 42% decline compared to the original $100 million valuation. The agreement is expected to be approved by the court handling Terraform Labs’ bankruptcy case. As a reminder, a bankruptcy judge accepted the request to halt Terraform Labs’ operations in September, following a settlement with the SEC. The Avalanche Foundation emphasized that this agreement would contribute further to the AVAX ecosystem, and the development has been well-received by the AVAX community. According to TradingView data, after the announcement, the price of AVAX rose from $25.14 to $29.57.

Third Assassination Attempt on Trump Prevented

Former U.S. President Donald Trump survived a third assassination attempt ahead of a campaign rally in California. Riverside County Sheriff Chad Bianco stated that a suspect armed with weapons was apprehended near a checkpoint close to the rally venue in Coachella Valley. A search of the suspect’s vehicle revealed a fake entry pass, an illegally obtained loaded shotgun, a handgun, and a high-capacity magazine. Vem Miller, a 49-year-old individual, was arrested in connection with the incident. Sheriff Bianco noted that Miller is believed to be a member of a right-wing, anti-government group and had planned to assassinate Trump. This incident marks the third assassination attempt on Trump, which authorities successfully thwarted with timely intervention.

SEC Commissioner Mark Uyeda’s Sharp Criticism of Crypto Policy

SEC Commissioner Mark Uyeda criticized the U.S. Securities and Exchange Commission’s (SEC) policies on cryptocurrencies, calling the agency’s enforcement-based approach instead of clear rules a “disaster.” Uyeda accused SEC Chair Gary Gensler of applying unclear policies, which has led to inconsistent court rulings. According to Uyeda, guidelines that clarify which crypto assets are subject to securities laws are urgently needed.

BTC Analysis:

Let’s evaluate Bitcoin using ITB analyses available on our EgeMoney website:

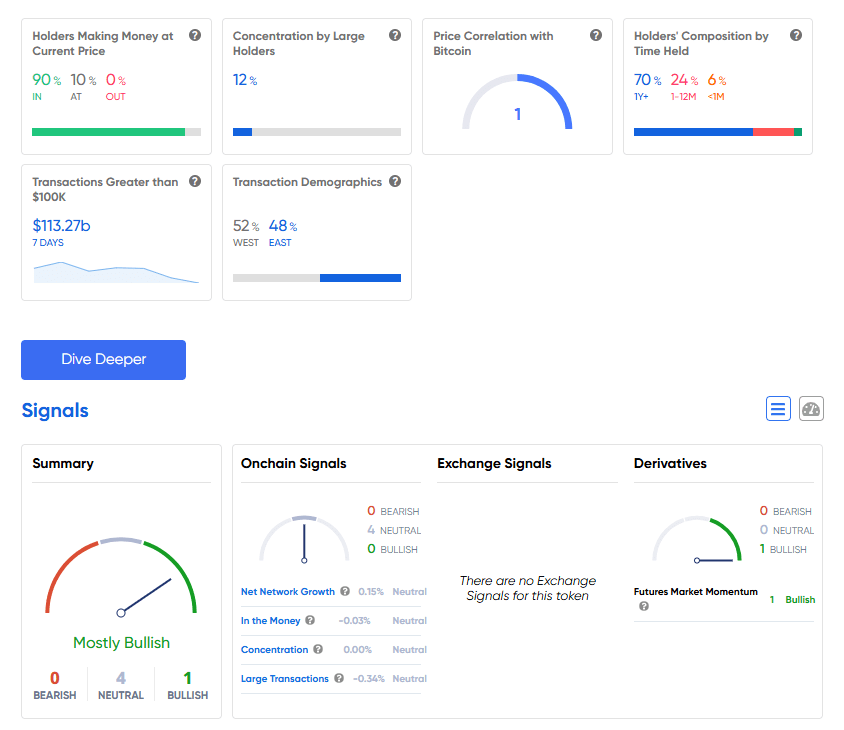

Currently, 90% of investors are in profit, indicating that most of the market is benefiting from the current prices. Last week, this rate was 89%, showing a small increase in the number of winners. Meanwhile, the influence of large investors, or “whales,” on the market remains at 12%, the same as last week.

70% of investors hold their assets for more than 1 year, 24% for 1-12 months, and only 6% for less than a month, showing no change in these figures.

This week, there are 4 “Neutral” and 1 “Bull” market expectations in ITB analyses. There are no “Bear” market expectations, suggesting that this week may turn out to be positive. However, it’s still advisable to use “Take Profit” and “Stop Loss” orders for more cautious steps in our trades.

“The investment information and comments included in this research report do not constitute investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.