Will the Decline in Cryptocurrencies Continue?

| Date | Time | Currency | Event | Expectation | Previous Data |

|---|---|---|---|---|---|

| 8 July, Monday | ETH | Ethereum (ETH) community conference | |||

| 9 July, Tuesday | 17:00 | USD | Speech by FED Chair Jerome Powell and US Treasury Secretary Janet Yellen | ||

| 10 July, Wednesday | 17:00 | USD | Powell’s speech | ||

| 11 July, Thursday | 15:30 | USD | US Consumer Price Index (CPI) data (annual) (Jun) | 3.1% | 3.3% |

| 11 July, Thursday | 15:30 | USD | Consumer Price Index (CPI) (Monthly) (Jun) | 0.1% | 0.0% |

Key Reasons for Bitcoin’s Decline

Huge Transfer from MT Gox

A new development has occurred in one of the largest bankruptcies in the cryptocurrency world, the Mt. Gox case. (Founded in Japan in 2010, Mt. Gox was once the world’s largest Bitcoin exchange, handling more than 70% of global Bitcoin transactions. However, in 2014, the exchange announced that approximately 850,000 Bitcoins, worth about $450 million at the time, had been stolen, sparking a major crisis.) Now, the bankrupt exchange has taken a significant step before making large-scale repayments to its creditors by transferring 47,229 BTC to a different wallet. This move has raised concerns in the cryptocurrency world and triggered a new wave in the markets.

The Giant Transfer of Bitcoin Whales

Last week, two major Bitcoin whales made a noteworthy move. These whales transferred approximately 9,500 Bitcoins, valued at around $532 million USD, from their cold wallets to the Binance exchange. This transaction generated significant interest in the cryptocurrency market and led to various speculations. Such large transfers are crucial indicators of market activity. The movements of whales, especially in a highly valuable and volatile asset like Bitcoin, are closely monitored by small investors and market analysts. This significant transfer to Binance is interpreted as a potential indication that the whales may plan to sell in the short term.

The Decline in Bitcoin Prices Puts Miners in a Difficult Position

When the Bitcoin price fell to the $54,000 level, miners began to struggle to make a profit. Mining consumes a significant amount of energy, leading to high electricity costs. For miners to be profitable, the Bitcoin price needs to be at least around $51,000-52,000. This can be considered a support level for Bitcoin. When Bitcoin falls to these levels, miners may be forced to sell their Bitcoin holdings to cover their costs, adding additional selling pressure to the market, which could further drive down the prices.

Justin Sun’s Efforts to Stabilize the Market

Amid the declines in Bitcoin, Justin Sun, the founder of Tron, has made an offer to purchase the Bitcoins held by the German government. This initiative aims to minimize the negative impacts of large-scale Bitcoin sales on the market. The German government began selling a portion of the approximately 50,000 BTC it seized through criminal operations, creating downward pressure on the market. Justin Sun announced his intention to negotiate directly with the German government to buy $2.3 billion worth of Bitcoin. This proposal seeks to facilitate the transfer of this large amount without causing significant fluctuations in Bitcoin’s market price. Sun’s action is seen as part of his efforts to maintain market stability.

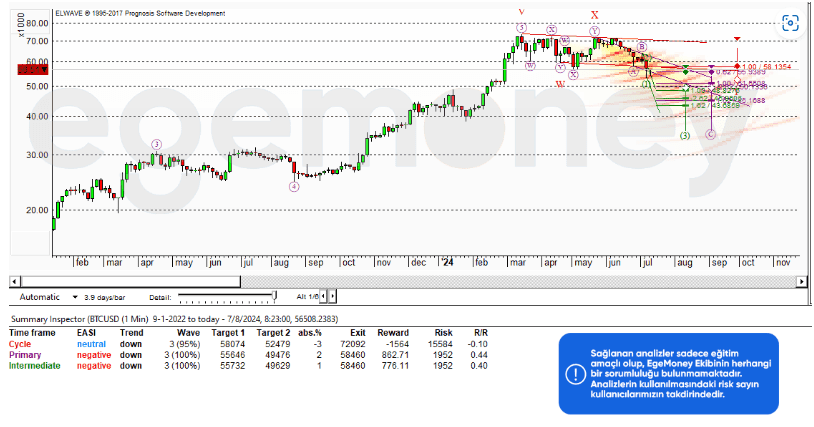

BTC Analysis:

According to the Elliot Wave Theory analysis on the EgeMoney website, short-term targets of around $49,500 can be expected. Last week, the expected level of $55,000 USDT according to the Elliot Wave analysis was reached. The long-term outlook is turning neutral. However, it is advisable to closely monitor the sales by governments and the bankrupt exchange Gox. If these sales deepen, we might see the expected levels of $49,500. Nonetheless, there is no need to be pessimistic in the medium to long term. Once this temporary period is over, Bitcoin is expected to continue its upward trajectory.

“The investment information and comments in this research report are not investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.