Gold or Bitcoin?

In recent years, investors have tended to choose between traditional gold and the digital asset Bitcoin. Here, we will analyze the performance of Gold and Bitcoin over the past five years and examine which asset has yielded higher returns for investors.

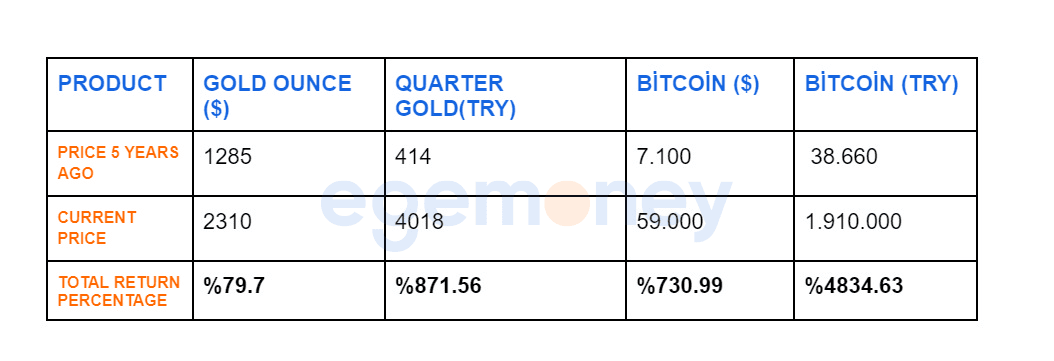

While gold has long been considered a safe haven, Bitcoin has been encountering increasing interest. Below, you can examine the summary of the performance of both assets from the following chart:

*The prices for the month of May over the years have been used for calculation.

In this table, we see the five-year investment performance of different asset types. The percentage returns for Troy ounce gold, quarter gold, and BTC/USD and BTC/TRY, represent the profit made over a specific period.

Profits In The Last 5 Years

%79.7

For Ounce gold, the price five years ago was $1285, which has risen today to $2310. This indicates a return of approximately 79.7% in dollar terms.

Profits In The Last 5 Years

%871.56

For quarter gold, the price in the same period increased from 414 TL to 4018 TL. This resulted in a return of 871.56% in Turkish lira.

Profits In The Last 5 Years

% 730

When examining Bitcoin in dollar terms, the price five years ago was $7100, and in May 2024, it has risen to $59,000. This shows a return of approximately 730% in dollar terms.

Profits In The Last 5 Years

%4834

Finally, the Bitcoin price, which was 38,660 TL five years ago, has reached 1,910,000 TL today, yielding a return of about 4834% in Turkish lira.

The significant price increases shown by Bitcoin in the last five years have attracted investors and provided substantial returns for some. However, this volatility has also brought with it high risks. Gold, on the other hand, has shown more stable performance and is considered a less risky asset.

Looking back at investments made five years ago, a Bitcoin investment purchased for 38,660 TL has reached 1,910,000 TL today, yielding a return of about 4834% in Turkish lira. This indicates that Bitcoin has experienced a significant increase in value in Turkish lira over the past five years. The appreciation of Bitcoin during this period has been quite attractive for investors, highlighting the high return potential of this asset class. During this time, Bitcoin has shown a remarkable performance compared to other traditional asset classes. This situation shows that interest in cryptocurrencies is increasing and that investors are starting to turn to these types of assets to diversify their portfolios.

Conclusion:

♦ Both assets have different characteristics and offer varying return potentials depending on investor preferences. While gold is considered a traditional safe haven, Bitcoin is seen as a new and innovative asset. Investors should carefully evaluate both assets based on their risk tolerance and long-term goals.

“The investment information and comments contained in this research report are not intended as investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.