| Date | Time | Currency | Case | Expectation | Previous Month’s Announced Data |

| May 22, Wednesday | 21:00 | Federal Open Market Committee (FOMC) Meeting Minutes | |||

| May 23, Thursday | 16:45 | USD | Services Purchasing Managers’ Index (PMI) (May) | 51,5 | 51,3 |

| May 23, Thursday | 14:00 | TRY | Türkiye Centran Bank Interest Rate Decision | 50,00% | 50,00% |

| May 23, Thursday | Last day for the SEC to decide on VanEck’s ETF application | ||||

| May 24, Friday | ETH | Ethereum (ETH) Berlin event starts |

Tether Reserves

Tether, the company behind USDT, the world’s largest stablecoin issuer, announced a record net profit for the first quarter of 2024. The company earned a net profit of $4.52 billion during this period, with a significant portion of this profit coming from US Treasury bonds, Bitcoin, and gold. Tether stated it holds $91 billion worth of US Treasury bonds and $5.4 billion worth of Bitcoin. Tether’s investments in US Treasury bonds constitute a large portion of the reserves backing its stablecoins. These investments are seen as part of the company’s strategy to maintain liquidity and enhance resilience against market volatility. Tether’s total reserves surpass its digital tokens and other liabilities, demonstrating its financial strength and stability. Additionally, Tether has made investments in various sectors, particularly in renewable energy, artificial intelligence, peer-to-peer communication, and Bitcoin mining. These investments further reinforce the company’s mission and financial health. Tether CEO Paolo Ardoino emphasized the company’s commitment to transparency, stability, and responsible risk management. The company’s financial reports, providing a detailed breakdown of its reserves and liabilities, aim to set new standards for transparency and trust in the cryptocurrency industry.

Coinbase Believes Spot Ethereum ETF Approval is Near Coinbase believes the probability of the US Securities and Exchange Commission (SEC) approving spot Ethereum ETFs by the end of the month is between 30% and 40%. This assessment is based on the current status of the SEC’s review process for spot Ethereum ETF applications. Coinbase Institutional Research Analyst David Han emphasized that the SEC is not obligated to approve all spot Ethereum ETFs simultaneously. Han noted that different ETF applications could be evaluated separately and that a gradual approval process could be followed. Coinbase anticipates that the approval of spot Ethereum ETFs would have a significant impact on the market, increasing institutional investors’ interest in Ethereum. This could lead to notable increases in Ethereum’s price and liquidity. Additionally, the approval of ETFs could provide greater confidence and stability in the overall cryptocurrency market.

Chainlink (LINK) Bulls Reawaken

According to blockchain analysis platform Santiment, Chainlink (LINK) bulls have resumed trading after a year-long hiatus. Chainlink was one of the standout altcoins over the past week. According to CoinGecko, LINK’s price rose by approximately 30% over the past week. Investors have renewed their interest in LINK after a long period, leading to an increase in its value.

BTC:

For expectations regarding Bitcoin, refer to ITB analyses available on our Egemoney website.

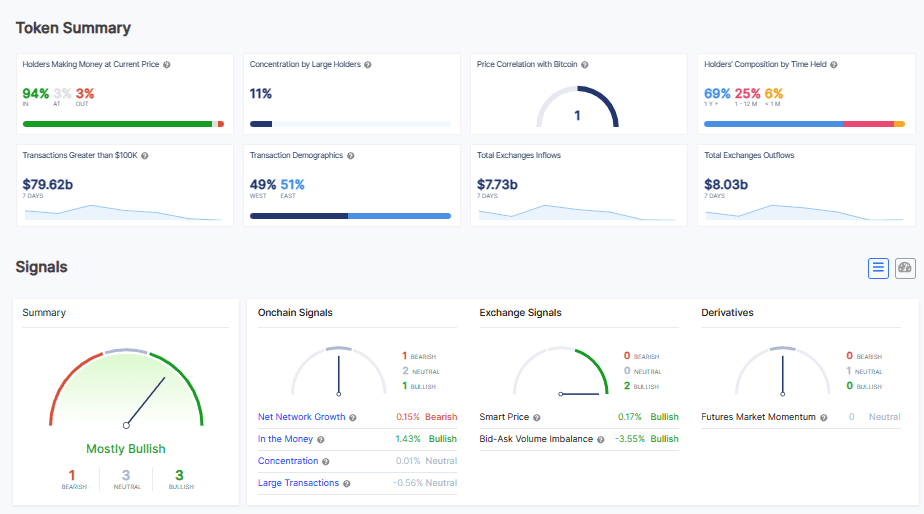

We have observed that the profit ratio of Bitcoin holders has increased from 90% to 94% this week. Total exchange inflows have risen to $7.73 billion, while total exchange outflows have reached $8 billion. We see an increase in both inflows and outflows, indicating a rise in both buying and selling activities on exchanges. Whale transaction volumes have also increased this week, from $64.92 billion to $79.62 billion. According to ITB analyses, there are 1 “Bearish,” 3 “Bullish,” and 3 “Neutral” expectations.

ETH:

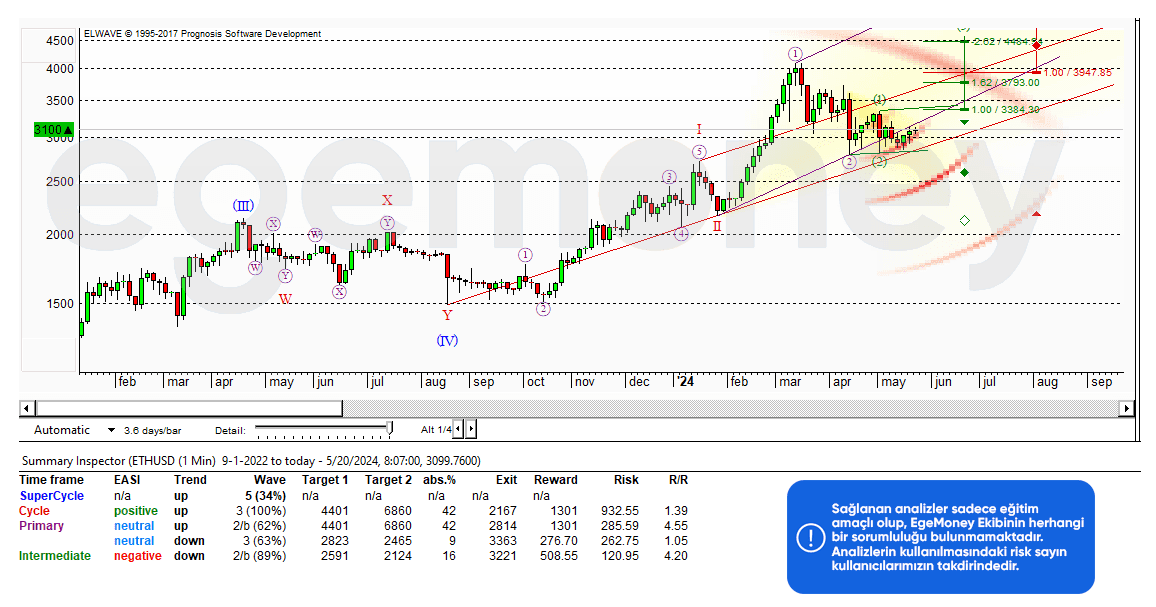

According to Elliott Wave Theory, analysis results indicate a negative start in the short term, becoming neutral in the medium term, and showing an increasing expectation of a positive trend in the long term. The results from the third wave are generally more successful, and here, there is a positive signal outlook for the medium to long term from the third wave. Elliott Wave Theory has strong expectations for Ethereum. Therefore, dips could present buying opportunities for Ethereum.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.