Weekly Economic Calendar

| Date | Time | Currency | Event | Expectation | Previously Announced Data |

|---|---|---|---|---|---|

| February 24, Monday | 13:00 | EUR | Eurozone – Consumer Price Index (CPI) (YoY) | 2.5% | 2.5% |

| February 24, Monday | ETH | Ethereum Pectra upgrade goes live on testnet | |||

| February 26, Wednesday | G20 Summit | ||||

| February 26, Wednesday | NVIDIA’s earnings report | ||||

| February 27, Thursday | 16:30 | USD | Gross Domestic Product (GDP) (QoQ) (Q4) | 2.3% | 3.1% |

| February 27, Thursday | 15:30 | EUR | European Central Bank Monetary Policy Meeting Minutes | ||

| February 28, Friday | 10:00 | TRY | Turkey Gross Domestic Product (GDP) (YoY) (Q4) | 2.1% |

Ethereum (ETH) Price Fluctuates Following Bybit Hack Attack!

Crypto exchange Bybit recently suffered a massive cyber attack amounting to $1.4 billion. This event is considered one of the largest thefts in crypto history. Following the attack, Bybit made Ethereum (ETH) purchases, which led to a temporary price surge in the market. However, after this rise, ETH price declined again.

After the major security breach, Bybit stated, “We have fully covered the ETH deficit.” The company’s CEO, Ben Zhou, emphasized that the exchange remains financially stable and announced that they will soon publish a new audit report. This move is seen as an important step towards restoring investor confidence.

SEC Officially Closes OpenSea Investigation

In August 2024, the SEC sent a Wells notice to OpenSea, initiating an investigation into allegations that the platform was involved in unregistered securities sales. However, according to an official announcement made yesterday, this investigation has been closed. This development has significantly alleviated concerns regarding the classification of NFTs as securities. The long-standing regulatory uncertainty in the crypto and NFT markets has been a source of anxiety for investors. The SEC’s decision to close the investigation is seen as a move that could restore confidence in the NFT market.

Brazil Approves the World’s First Spot XRP ETF!

A historic development has taken place in the crypto market! Brazil has approved the first-ever spot XRP ETF, which will be managed by Hashdex. This new financial product will be traded on B3, one of the country’s leading stock exchanges. This move further solidifies Brazil’s leadership in the Latin American crypto market.

Between the end of 2023 and early 2024, cryptocurrency transactions exceeding $1 million increased by 48.4%, proving the growing interest of major investors in the country. In terms of total crypto asset volume, Brazil ranks second in the region, just behind Argentina.

Brazil’s approval of the XRP ETF comes at the same time as ongoing spot XRP ETF applications in the U.S.. Analysts estimate that the U.S. Securities and Exchange Commission (SEC) has an 80% probability of approving an XRP ETF by 2025. Meanwhile, Solana (SOL) and Litecoin (LTC) ETF applications are also under SEC review.

SEC’s Decision on Litecoin ETF Awaited

The spot Litecoin ETF (LTCC), which has sparked excitement in the crypto market, has reached a crucial stage in the approval process. The fund, submitted by Canary Capital, has been added to the ETF list by the Depository Trust & Clearing Corporation (DTCC). While this signals progress in the process, it does not guarantee the ETF’s official launch.

The fund remains under SEC review as part of a 19b-4 filing published by Nasdaq on February 4 in the Federal Register. The SEC has up to 90 days to approve or reject the proposal. If approved, Litecoin will become the first cryptocurrency outside of Bitcoin and Ethereum to have a spot ETF.

Bloomberg’s top ETF analysts, James Seyffart and Eric Balchunas, estimate that the SEC has a 90% chance of approving a spot Litecoin ETF by the end of the year. Experts believe that Litecoin is highly likely to be classified as a commodity by the SEC, a crucial factor that could facilitate its approval.

Costa Rica’s Largest Bank Moves to Offer Spot Bitcoin ETF!

Costa Rica’s largest bank, Banco Nacional (BN), has announced that it will offer investors access to a spot Bitcoin ETF for the first time. This new investment product, available through BN Fondos, provides investors with an opportunity to access Bitcoin through the banking system.

Banco Nacional is not only launching a Bitcoin ETF but also an S&P 500 ETF, aiming to integrate itself further into global financial markets. The minimum investment amount is set at $100, and all transactions will be conducted in U.S. dollars.

The bank’s General Manager, Pablo Montes de Oca, stated that Costa Rican regulations do not permit non-investment products, but ETFs are recognized as investment instruments. This is seen as a critical step toward granting Bitcoin and other digital assets an official investment status.

Costa Rica’s decision could pave the way for wider adoption of Bitcoin and crypto assets in Latin America’s financial system.

BTC:

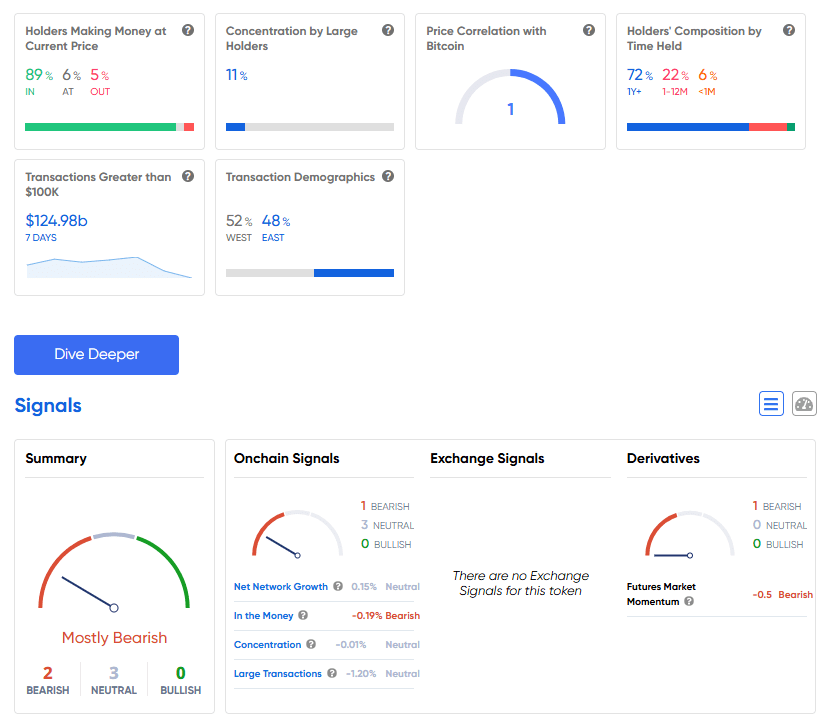

Let’s analyze Bitcoin along with ITB data.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.