Weekly Economic Calendar

| Date | Time | Currency | Event | Expectation | Previous Month Announced Data |

|---|---|---|---|---|---|

| September 23, Monday | BTC | U.S. House of Representatives Committee to hold cryptocurrency sessions | |||

| September 26, Thursday | 15:30 | USD | U.S. Gross Domestic Product (GDP) (Quarterly) (Q2) | 3.0% | 1.4% |

| September 26, Thursday | 16:20 | USD | Speech by Fed Chairman Powell |

Bitcoin and Cryptocurrencies Rise After Fed Rate Cut

The Federal Reserve (Fed) has cut interest rates by half a percentage point for the first time in over four years, and this decision triggered a market rally for Bitcoin and other cryptocurrencies. Following the rate cut, the cryptocurrency markets showed a strong upward movement.

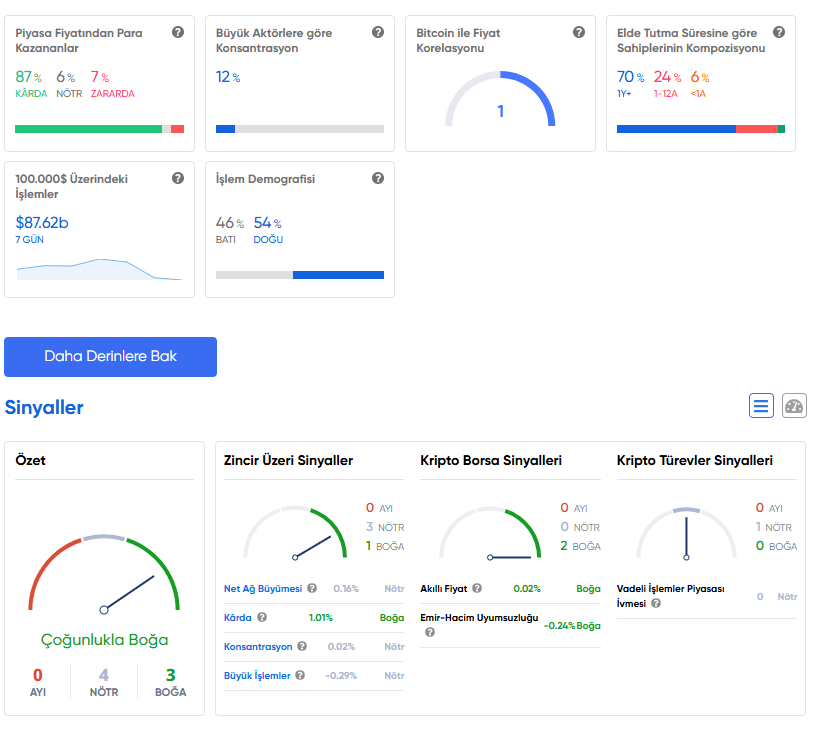

Performance of Bitcoin and Cryptocurrencies

According to Coin Metrics data, the price of Bitcoin increased by 5%, rising above the $63,000 level. This increase is based on an upward trend that began before the Fed’s rate cut decision. Bitcoin experienced a sharp rise immediately after the Fed’s decision on Wednesday; however, prices partially pulled back as investors digested the news. Cryptocurrencies, like stocks, are sensitive to economic news and can show volatility following actions such as rate cuts. This positive effect on the crypto market following the rate cut has increased investors’ interest in digital assets like Bitcoin.

Eski ABD Başkanı ve 2024 Cumhuriyetçi başkan adayı Donald Trump, New York’taki bir Bitcoin barı olan Pubkey‘de Bitcoin ile ödeme yaparak kripto parayı bir işlemde kullanan ilk eski ABD başkanı oldu. Trump, 18 Eylül’de ünlü bar ve restoranda yaptığı bu işlemle, kripto dünyasında dikkatleri üzerine çekti.

Bu olay, kripto paraların gerçek hayatta kullanımına yönelik önemli bir adım olarak değerlendiriliyor. Trump’ın Bitcoin ile hamburger alması, kripto para dünyasında geniş yankı uyandırdı ve Bitcoin‘in günlük işlemlerde kullanımına ilişkin olumlu bir örnek teşkil etti.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.