Weekly Economic Expectations:

| Date | Time | Currency | Event | Expectation | Previous Month Data |

|---|---|---|---|---|---|

| 24th December, Tuesday | 13:00 | USD | USA – Christmas Holiday – Early closure | – | – |

| 25th December, Thursday | 14:00 | TRY | Turkey Interest Rate Decision | 48.50% | 50% |

Due to the Christmas holiday in the USA, financial markets will have an early close on 24th December (Christmas Eve) and will be fully closed on 25th December (Christmas Day). Additionally, some markets may open with low trading volume on 26th December (Boxing Day). On 31st December (New Year’s Eve), markets will close in the afternoon and will be fully closed on 1st January (New Year’s Day). A low trading volume is expected during this period.

Cardano’s Rise with Hydra

Cardano is making significant progress in its journey to rival Ethereum in the blockchain world. At the heart of this breakthrough is Hydra, a scalability solution developed by Cardano. Hydra enhances the speed and efficiency of the Cardano network, accelerating the platform’s growth. This solution has enabled the value of the ADA token to rise above 1 USD and has allowed Cardano’s decentralized application (dApp) ecosystem to expand rapidly. Hydra significantly increases the transaction capacity of the Cardano network and has the potential to reach up to 100,000 transactions per second. This offers a capacity far beyond Ethereum’s current transaction power. Thanks to this innovative solution, Cardano provides users with a more efficient experience, offering faster transaction confirmations and lower transaction fees. This speed gives Cardano a significant advantage, especially in rapidly growing fields like decentralized finance (DeFi) projects and NFTs. The impact of Hydra is not limited to technical capacity; it has also caused a major rise in the value of ADA. This development is increasing investors’ interest in Cardano, allowing the platform to appeal to a broader user base. The ADA price rising above 1 USD contributes to Cardano being recognized as a strong blockchain platform. Cardano’s success with Hydra is not only creating a strong competitor to Ethereum but is also considered a significant step for the future of blockchain technology. With its high transaction capacity and rapidly growing dApp ecosystem, Cardano continues to establish a solid position in the blockchain world.

South Korea’s Exchange Chairman Jeong Eun-bo on Crypto Market Institutionalization

Jeong Eun-bo, the Chairman of South Korea’s Exchange, stated that the crypto market needs to institutionalize rapidly, or the country will fall behind in global competition. He noted that the trading volume of the crypto market has surpassed that of the local stock exchange, and emphasized that regulations must be implemented as soon as possible. However, South Korea’s delay in approving Bitcoin spot ETFs and postponing regulatory actions until 2025 is slowing the growth of the sector. The chairman expressed that the uncertainty in regulations will weaken the country’s competitiveness in international markets.

40 Billion Dollar Bitcoin Claim for UAE

Binance CEO Changpeng Zhao (CZ) brought up an article claiming that the United Arab Emirates (UAE) holds 40 billion USD worth of Bitcoin. This claim has been questioned by legal experts like Irina Heaver, who criticized the reliability of the article and pointed out that no concrete evidence was presented to support the claim. In response to these doubts, Zhao admitted that there is no definitive information about the accuracy of the stated amount. “I am also curious how they arrived at this number because gathering such data is really difficult,” he commented. However, Zhao acknowledged that while the claimed amount of Bitcoin might be overestimated, given the concentration of wealthy individuals in the UAE, such a large accumulation of assets might be possible. He believes such a claim wouldn’t be made without reason, as no one would fabricate such a number.

MicroStrategy’s Bitcoin Portfolio

MicroStrategy currently holds 439,000 BTC, worth over 41 billion USD. This company holds more Bitcoin than the amount claimed for the UAE, and its investments have led to a significant increase in its stock price this year.

Crypto Hedge Funds Break Records

Crypto hedge funds achieved impressive gains in November, with a 46% return. Funds that generated a 76% return throughout 2024 performed far above traditional hedge funds.

NFT Sales Continue to Grow: 33% Increase to 302 Million USD

The NFT market experienced significant growth in the final quarter of 2024. According to the latest data, NFT sales volume increased by 33%, reaching 302 million USD. This indicates growing demand for digital art and collectibles and shows that NFTs are garnering interest from a wider range of investors. The growth in the market has also led to some collections reaching high sale prices. For example, an NFT from the Pudgy Penguins collection sold for approximately 494,000 USD. This record sale signals that digital assets with collectible value are gaining worth and reflects the growing mainstream interest in the NFT sector.

BTC:

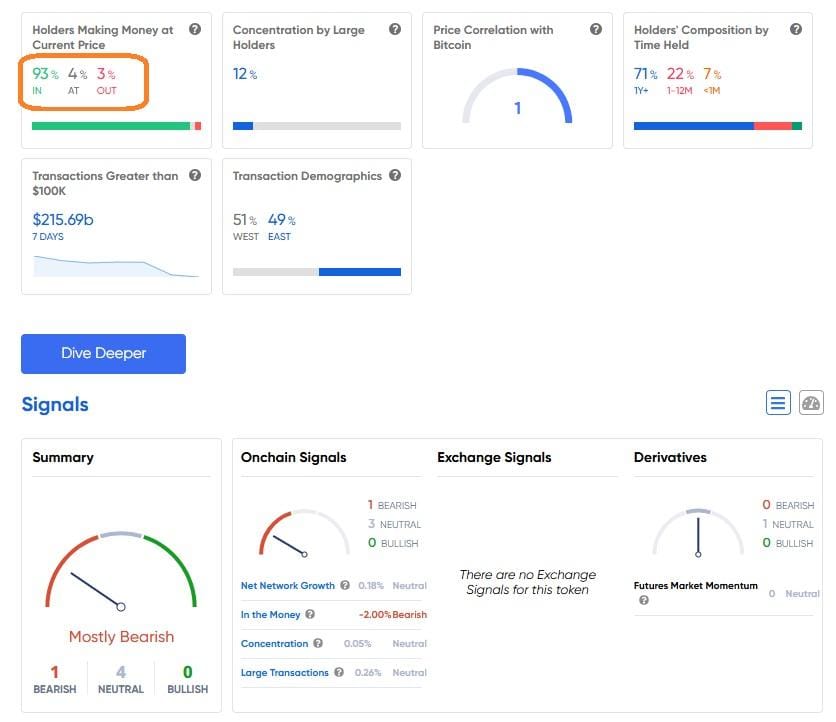

Bitcoin investors were at a 100% profit last week, but now the situation shows a 93% profit, 3% loss, and 4% neutral. The trading volume of whales has decreased from 222.29 billion USD last week to 215.69 billion USD this week. This indicates that whales are adopting a more cautious approach in the market, and large trading volumes have diminished. ITB analysis shows “4 neutral,” “0 bullish,” and “1 bearish” market expectations for Bitcoin. From this data, we can infer that the market has reached a state of balance.

“Investment information and comments in this research report are not intended as investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.