| Weekly Economic Calendar | |||||

|---|---|---|---|---|---|

| Date | Time | Currency | Event | Expectation | Previously Announced Data |

| November 4, Monday | 10:00 | TRY | Consumer Price Index (CPI) (October) | 48.20% | 49.38% |

| November 5, Tuesday | 13:00 | USD | U.S. Presidential Elections | ||

| November 6, Wednesday | First Meeting of the South Korean Virtual Asset Committee | ||||

| November 7, Thursday | 21:00 | USD | Fed Interest Rate Decision | 4.75% | 5% |

| November 7, Thursday | 22:30 | USD | FOMC Press Conference |

The likelihood of Donald Trump winning the upcoming U.S. presidential election has declined by over 10% from its peak levels in prediction markets. Despite this drop, Trump continues to stay ahead of his rival, Vice President Kamala Harris. Théo, a French investor who has placed significant bets on Trump via Polymarket, stated that his investments are not politically motivated. He expressed confidence in his analysis, noting that if Trump wins, he stands to gain up to $80 million. Théo estimates Trump’s actual chance of winning to be between 80% and 90%.

Potential Effects of the U.S. Elections

- Political Uncertainty and Market Reaction

Periods before and after elections generally see an increase in uncertainty within the markets. This uncertainty can drive investors toward safer assets. Bitcoin might experience heightened demand during such periods, being seen as a safe haven similar to gold. Additionally, U.S. indices could exhibit volatility depending on the election outcome. Policies related to taxes and economic stimulus packages could have direct impacts on the stock markets. - Cryptocurrency Regulations

A new administration could bring stricter or more lenient regulations for cryptocurrencies, directly influencing Bitcoin’s price. A crypto-friendly administration might create a favorable environment for Bitcoin and other digital assets, potentially driving prices up. Conversely, tighter regulations or anti-crypto policies could result in a downturn. - Effects on the U.S. Dollar

The U.S. elections could influence the country’s economic and monetary policies, impacting the strength of the dollar. A weaker dollar is generally considered positive for Bitcoin and other cryptocurrencies, as it pushes investors toward alternative assets. - Fluctuations Tied to Macroeconomic Policies

Election outcomes may trigger macroeconomic policies such as new stimulus packages and economic reforms. Such policies could alter risk appetite and market expectations, affecting both Bitcoin and U.S. indices. Large stimulus packages could support rallies in U.S. indices, while increased inflation expectations and a growing money supply could be positive for Bitcoin. - Investor Confidence and Market Sentiment

The market’s perception of the new administration post-election impacts investor confidence. A positive perception could lead to gains in U.S. indices and an increase in risk appetite. Bitcoin could benefit from this increased risk appetite or see higher interest as a digital safe haven alongside gold.BTC:

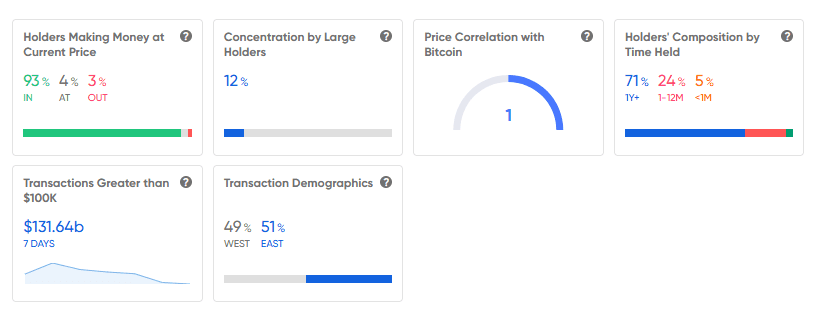

We see that 93% of investors are currently in profit, up from 92% last week but down from 95% the week before. These figures indicate a general upward trend in profitability. Whales maintain a 12% influence on the market, which has not changed compared to the previous week.

71% of investors hold their assets for more than one year, 24% hold them between 1-12 months, and only 5% hold them for less than one month. This indicates that the majority of investors are long-term and have confidence in their assets. There is a 1% increase in long-term holders compared to last week.

This week will be crucial. The U.S. elections on Tuesday and the Fed’s interest rate decision on Thursday will significantly increase market volatility. During this week, you will find that technical analysis alone may not be sufficient, so it will be beneficial to combine both technical and fundamental analyses in your trading. Additionally, using “Take Profit” and “Stop Loss” orders in your trades will be advantageous.Wishing everyone a week full of profitable opportunities and abundant gains.“The investment information and comments included in this research report do not constitute investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.