Economic Expectations in the Most Critical Week of the Month:

| Date | Time | Currency | Event | Expectation | Previous Month’s Data |

|---|---|---|---|---|---|

| July 31, Wednesday | 21:00 | USD | FED interest rate decision | 5.50% | 5.50% |

| August 2, Friday | 15:30 | USD | US Non-Farm Employment | 177K | 206K |

| August 2, Friday | 15:30 | USD | Average Hourly Earnings | %0.3 | %0.3 |

| August 2, Friday | 15:30 | USD | Unemployment Rate | %4.1 | %4.1 |

-Trump Spoke at the 2024 Bitcoin Conference

At the 2024 Bitcoin Conference, Trump stated that if elected, he would dismiss Gensler on his first day and end the crackdown on the crypto industry. He also mentioned that he would appoint an SEC chairperson who aims to build the future of Bitcoin and cryptocurrencies rather than obstructing it. Additionally, he expressed his desire for the US to become a “Bitcoin superpower” under his leadership. Following these statements, the price of Bitcoin increased by 2%, rising to over $69,000.

-Last Week, Spot Ethereum ETFs Started Trading

Last week, spot Ethereum exchange-traded funds (ETFs) began trading in the US, causing significant activity in Ethereum (ETH) futures on the Chicago Mercantile Exchange (CME). According to CME data, the number of open positions in Ethereum futures hit a record high of 7,661 contracts, exceeding 383,650 ETH and $1.4 billion. This marks a notable increase compared to the previous record of 7,550 contracts a month ago. The introduction of spot Ethereum ETFs has provided investors with the opportunity to buy and sell Ethereum directly, thereby increasing market liquidity. This development has also led to significant interest and activity in the futures market. The rising open positions in the futures market indicate that investors expect Ethereum prices to increase in the future.

-Toyota Plans to Integrate Ethereum Blockchain Technology into Its Vehicles

Another development related to Ethereum came from Toyota. According to a recent blog post by Blockchain Lab, the Japanese automotive giant plans to integrate Ethereum blockchain technology into its vehicles. This move demonstrates Toyota’s intention to use blockchain technologies in in-vehicle systems to offer a more secure and efficient driving experience. Toyota’s initiative could increase the use of blockchain technologies in the automotive sector and provide innovative solutions.

-XRP Unlock Event

In August, Ripple will unlock 1 billion XRP tokens. This could lead to some fluctuations in XRP prices. Historical data suggests that Ripple’s strategy of unlocking 1 billion XRP monthly has typically exerted short-term pressure on the price. Prices have tended to drop after these unlock events, but the market has balanced this in the long term.

-Solana Leads in Real-World Asset Tokenization

Solana is emerging as the leading non-EVM (Ethereum Virtual Machine) blockchain in the tokenization of real-world assets. Non-EVM blockchains use their unique virtual machines and technological infrastructures, making them incompatible with Ethereum’s smart contracts and dApps (decentralized applications). Solana’s key innovations, such as fast transaction times, high transaction volumes, and low fees, make the tokenization of real-world assets more efficient and accessible. For example, a company named Homebase has used Solana to tokenize real estate in Texas, USA, allowing even small investors to invest in real estate. Investors can buy and sell real estate ownership through NFTs, increasing accessibility to real estate investment and promoting financial inclusion.

BTC:

-Analyzing Bitcoin with the ITB analyses on EgeMoney website:

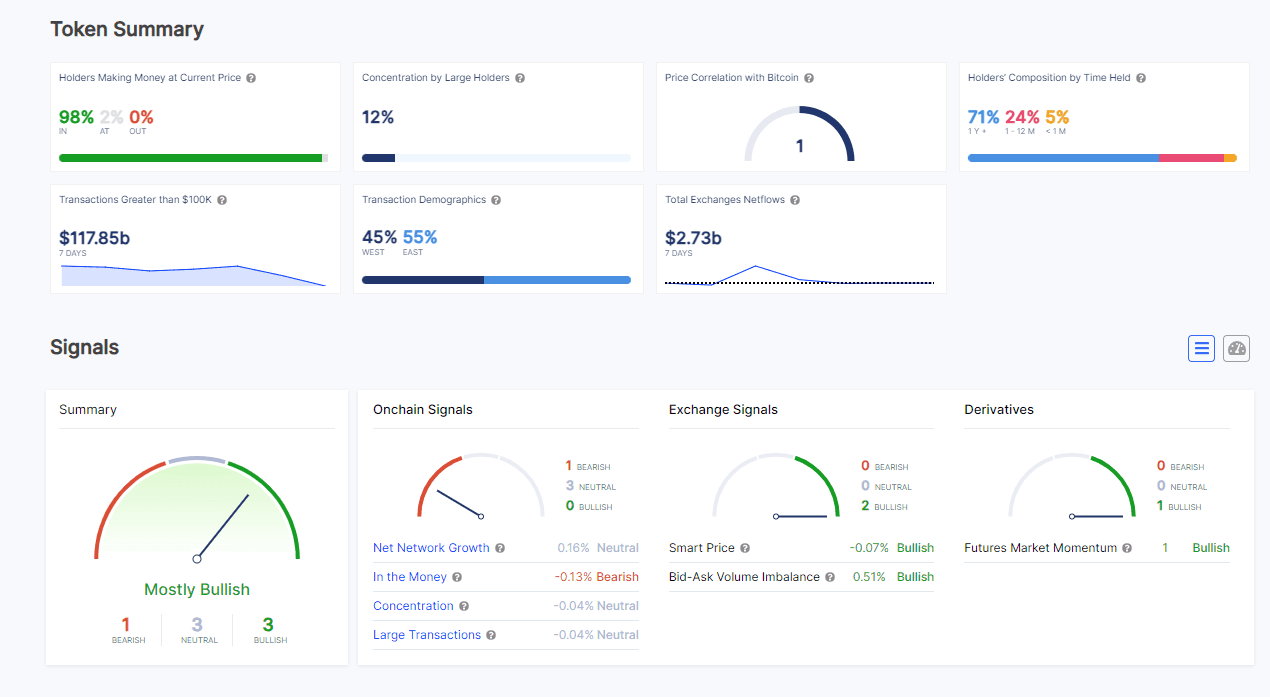

- Investments profitable at current prices: 98%

- Investments at a loss: 2%

-Composition of holders based on the holding period:- 71% ➡️ 1+ Year

- 24% ➡️ 1-12 Months

- 5% ➡️ <1 Month

This means 71% of investors have held their Bitcoin for over a year, 24% for 1-12 months, and 5% for less than a month.

-Transaction demographics:

- 45% ➡️ Western trading hours (This time zone indicates when investors in the Western Hemisphere, such as America and Europe, are actively trading.)

- 55% ➡️ Eastern trading hours (This time zone indicates when investors in the Eastern Hemisphere, such as Asia and Australia, are actively trading.)

-Current ITB analyses indicate 1 “bearish,” 3 “neutral,” and 3 “bullish” signals.

-If Bitcoin breaks above the $70,000 level, we could see a new all-time high. However, if a correction follows the rise triggered by Trump’s speech, support at around $65,000 could be broken downward.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.

- Gizem Günayhttps://blog.egemoney.com/en/author/gizemgunay/

- Gizem Günayhttps://blog.egemoney.com/en/author/gizemgunay/

- Gizem Günayhttps://blog.egemoney.com/en/author/gizemgunay/

- Gizem Günayhttps://blog.egemoney.com/en/author/gizemgunay/