Bitcoin Spot ETFs Continue to Break Records

BlackRock’s iShares Bitcoin Trust ETF (IBIT) achieved a net inflow of $2.05 billion in just one week, solidifying its leadership in the sector. Fidelity’s Fidelity Bitcoin ETF (FBTC) saw a net inflow of $773 million during the same period.

Gensler’s Resignation

Gary Gensler, the Chair of the U.S. Securities and Exchange Commission (SEC), announced his resignation, effective January 20, coinciding with Donald Trump’s inauguration as president. This news has been a significant factor in Bitcoin’s recent price surge. During his tenure, Gensler took a stringent stance on the crypto industry, emphasizing regulatory measures. However, his resignation raised expectations of reduced regulatory pressure, positively impacting Bitcoin prices.

The identity of the next SEC Chair remains unclear, with potential candidates including Robinhood’s Chief Legal Officer Dan Gallagher, former SEC Commissioner Paul Atkins, and current Commissioner Mark Uyeda.

Solana (SOL) and Spot ETF Developments

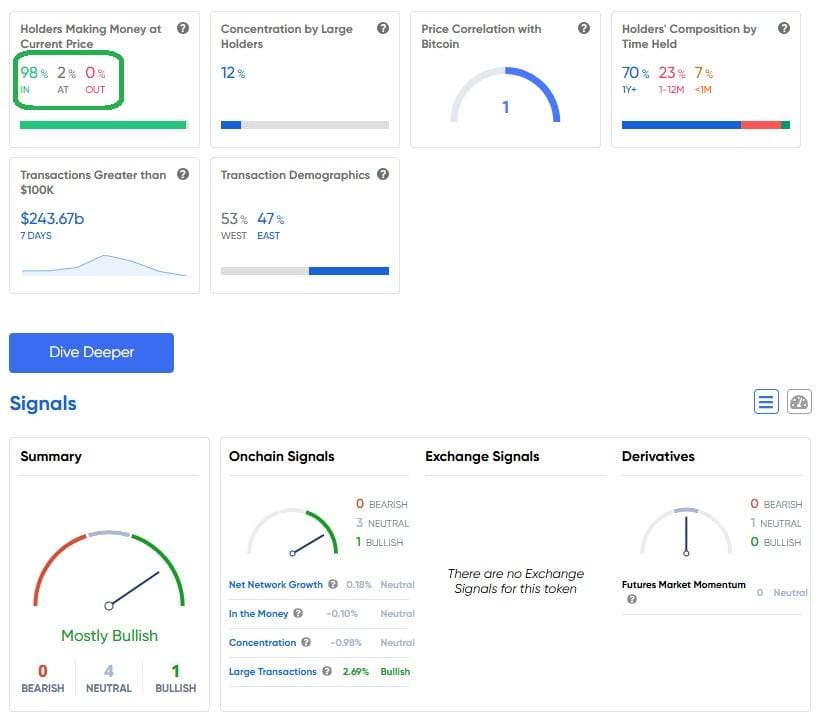

In recent weeks, Solana has garnered attention with its strong price rally, approaching all-time highs and boosting investor confidence. Key drivers of this rise include ecosystem growth, increased institutional interest, and Solana’s fast, low-cost transaction infrastructure.

- The Cboe BZX Exchange has filed four spot ETF applications for Solana, aiming to facilitate institutional access to crypto assets. These ETFs offer new investment products, including baskets of Solana, DeFi, NFTs, and multi-asset portfolios. If approved by regulators, these ETFs could significantly boost Solana’s price and adoption.

- As the SEC’s approval process continues, this step is seen as a potential turning point not just for Solana but for the entire crypto market. With rising prices and new ETF developments, Solana is generating broader interest and opportunities in the crypto space.

Musk and Trump Propel Dogecoin

Dogecoin (DOGE) has regained attention recently due to developments involving Elon Musk and the crypto market. Musk’s appointment as the head of the U.S. Government Efficiency Department, whose acronym matches Dogecoin’s ticker “DOGE,” had a positive impact on its price. Additionally, Donald Trump’s crypto-friendly regulatory promises pushed Dogecoin’s market cap to $63.5 billion.

Meanwhile, the $258 billion Dogecoin manipulation lawsuit against Musk was dismissed after investor complaints were withdrawn. Musk’s exoneration bolstered market confidence, providing further support for Dogecoin’s rise.

Justin Sun’s $6.2 Million Investment

Justin Sun, founder of the TRON (TRX) blockchain platform, purchased Maurizio Cattelan’s artwork “Comedian” for $6.2 million. The piece, famously consisting of a banana duct-taped to a wall, is known for pushing the boundaries of contemporary art.

The auction at Sotheby’s in New York began with a starting price of $800,000, quickly escalating to $5.2 million amid intense interest. Including auction fees, Sun became the owner for $6.2 million.

After the purchase, Sun remarked, “This is not just an artwork; it represents a cultural phenomenon bridging the worlds of art, humor, and the crypto community. I believe this piece will inspire more thought and discussion in the future and become a part of history.”