Weekly Economic Calendar:

| Date | Time | Currency | Event | Forecast | Previous Data |

|---|---|---|---|---|---|

| November 18, Monday | TRY | G20 Summit | |||

| November 19, Tuesday | 13:00 | EUR | Eurozone – Consumer Price Index (CPI) (YoY) October | 1.7% | 2% |

| November 20, Wednesday | 10:00 | GBP | UK – Consumer Price Index (CPI) (YoY) October | 2.2% | 1.7% |

| November 21, Thursday | 14:00 | TRY | CBRT Interest Rate Decision | 50% |

“Ready to Celebrate $100,000!”

Michael Saylor, the founder of MicroStrategy and one of Bitcoin’s most prominent advocates, made a bold prediction regarding Bitcoin’s price. Saylor confidently stated that Bitcoin would not fall below the $60,000 level throughout 2024. Even more boldly, he predicted that Bitcoin would surpass $100,000 before the end of the year.

“I’m already planning the $100,000 celebration. Most likely, we’ll be marking this achievement at my home during the New Year. I’d be quite surprised if we don’t reach this level by November or December,” Saylor said.

Wall Street and Bitcoin ETFs

Wall Street’s major banks are increasing their investments in Bitcoin ETFs (Exchange-Traded Funds), signaling the potential for significant activity in the crypto market during Q4. Crypto-friendly policy developments and regulatory clarity are paving the way for heightened institutional interest.

As we enter the final quarter of 2024, the growing prominence of pro-crypto policies is a promising sign for the sector’s future. Preliminary approvals for crypto ETFs by U.S. regulatory authorities and the SEC’s favorable stance have been driving forces behind Wall Street’s increased investments in this space.

Crypto-friendly regulations are gaining attention, with a rising number of crypto-focused legislative proposals being introduced in Congress. These developments promise to bring more transparency and legal security to the digital asset sector. Additionally, plans by some central banks to evaluate Bitcoin and other digital assets highlight significant progress toward institutional adoption. Globally, the competition for crypto market leadership between the U.S. and Europe is accelerating the pace of regulatory implementation. Wall Street banks and other financial institutions increasing their crypto investments signal the long-term growth potential of the sector. Bitcoin ETFs may only be the beginning, with future corporate interest potentially extending to DeFi, NFTs, and other blockchain-based projects.

XRP Rally

XRP surged 30% in the last 24 hours, reaching $1.16.

This sharp rise is attributed to speculation about SEC Chairman Gary Gensler’s potential resignation and positive developments in Ripple’s legal battle. Gensler, often known for his stringent and restrictive approach to the crypto market, hinted at the possibility of stepping down in a recent speech. This has fueled expectations of a more crypto-friendly stance within the SEC moving forward.

Is Altcoin Season Here?

Raoul Pal, a prominent figure in the crypto world, has declared the long-awaited altcoin season has finally arrived. Pal emphasized the significant growth potential of altcoins such as Ethereum, Solana, and Sui during this period, urging investors to pay attention to these opportunities.

Altcoin season is typically defined as a phase when Bitcoin’s market dominance declines, and other crypto assets achieve rapid gains. According to Raoul Pal, this season is expected to be much broader and more impactful than previous years. The increasing number of new investors entering the market and the continuous development of altcoin ecosystems are likely to further fuel this momentum.

Zcash (ZEC) Halving (November 23, Saturday)

An important halving event is approaching for Zcash (ZEC) holders. This event will result in mining rewards being halved, which typically impacts the supply-demand balance in crypto markets, potentially leading to price movements.

With the halving, the amount of new ZEC entering the market will decrease. If demand remains steady or increases, this reduced supply could exert upward pressure on the price. Historically, halving events in cryptocurrencies like Bitcoin have been followed by price increases. A similar trend could be observed with Zcash during the halving on November 23, Saturday. Investors with positions in ZEC should keep this date in mind.

BTC:

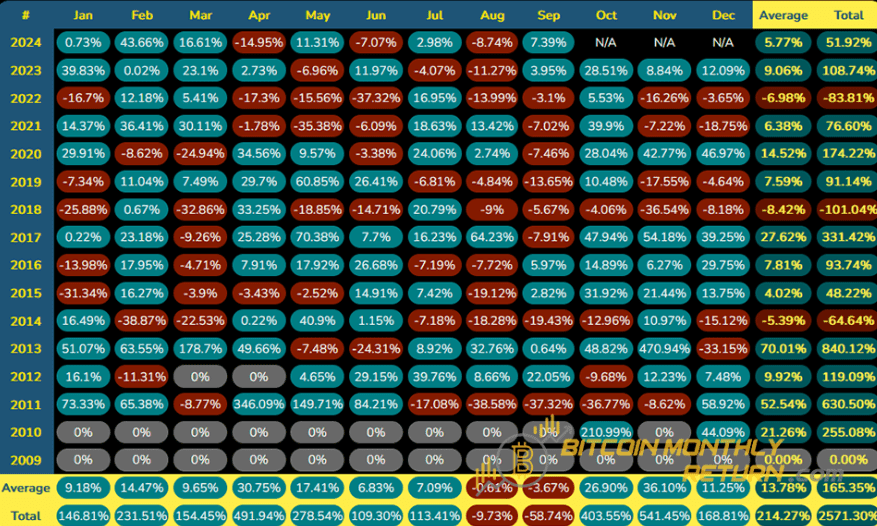

Bitcoin gained 30% in value throughout November, with monthly gains as follows:

Now, let’s examine it using ITB analyses:

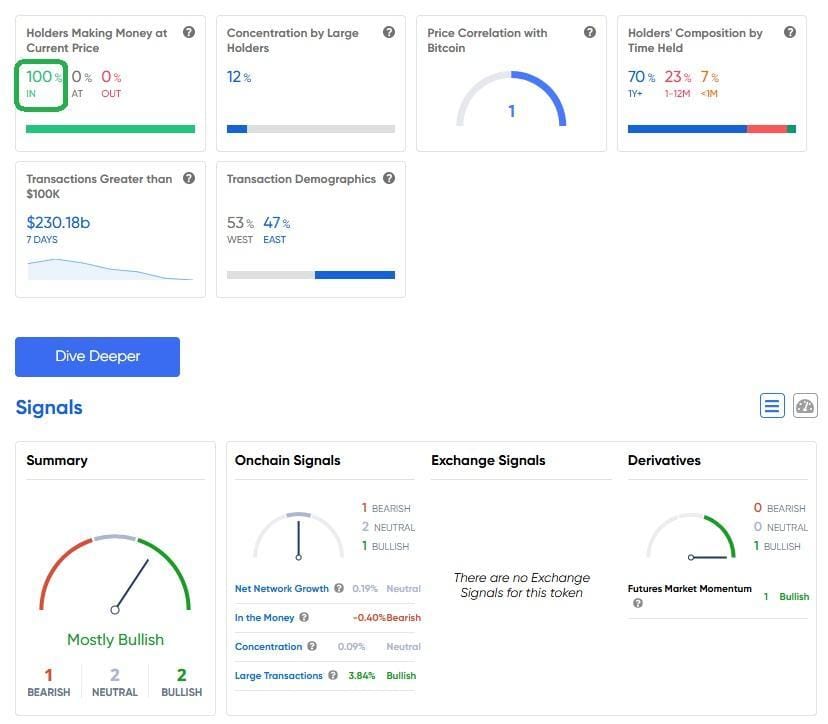

Those profiting from market prices remain at 100% levels this week, just like the previous week.

According to ITB analyses, the current outlook includes “2 neutral”, “2 bullish”, and “1 bearish” market expectations.

We observe that transactions above $100,000 have surged to $230.18 billion, breaking records.

Wishing you a pleasant week where all your trades turn out just as you hope! 💸

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.