Economic Expectations of the Week:

| Date | Time | Currency | Event | Expectation | Previously Announced Data |

|---|---|---|---|---|---|

| 30 September Monday | 20:55 | USD | FED Chair Powell Speech | ||

| 1 October Tuesday | 12:00 | EUR | Eurozone Annual CPI | 1.9% | 2.2% |

| 2 October Wednesday | 15:15 | USD | ADP Nonfarm Private Employment (Preliminary Data) (Sep) | 124K | 99K |

| 3 October Thursday | 10:00 | TRY | Consumer Price Index (CPI) (Annual) (Sep) | 51.97% | |

| 4 October Friday | 15:30 | USD | Nonfarm Payrolls (Sep) | 144K | 142K |

| 4 October Friday | 15:30 | USD | Unemployment Rate (Sep) | 4.2% | 4.2% |

| 4 October Friday | 15:30 | USD | Average Hourly Earnings (Monthly) (Sep) | 0.3% | 0.4% |

-Economic Confidence Index Hits Three-Month High

According to data released by the Turkish Statistical Institute (TÜİK) last week, the Economic Confidence Index reached a level of 95. With this development, economic confidence hit its highest level in the past three months. This indicates that confidence in the economy has been increasing recently. After the fluctuations of recent months, this recovery in economic confidence can be interpreted as a sign of a positive outlook in the markets and general economic expectations.

-U.S. Trade Deficit at Its Lowest Since March

The U.S. Department of Commerce shared data regarding the goods trade balance, wholesale, and retail inventories for August. According to the data, the “advance goods trade deficit” fell by 8.3% compared to the previous month, decreasing to $94.3 billion. With this drop, the goods trade deficit has reached its lowest level since March. Market expectations for this period were that the deficit would be around $100.6 billion, but it fell below expectations.

-This Week:

On October 3, the Governor of the Central Bank of the Republic of Turkey, Fatih Karahan, will present a report to the Parliamentary Planning and Budget Commission on the global economy, Turkey’s economic situation, inflation, and monetary policies. On the same day, the Turkish Statistical Institute (TÜİK) will release inflation data for September. In August, the Consumer Price Index (CPI) annual inflation stood at 51.97%.

-U.S. Non-Farm Payroll Data Under Market Focus

On Friday, at 15:30 Turkey time, the U.S. Non-Farm Payroll data for September is expected to show an increase of 144,000 jobs. In August, this increase was recorded as 142,000. Additionally, markets will be closely watching another key data point: average hourly earnings, which are expected to decrease from 0.4% to 0.3% on a monthly basis and from 3.8% to 3.3% annually. A higher-than-expected increase in employment could lead to slight rises in the dollar index and U.S. 10-year treasury yields. The unemployment rate is expected to remain steady at 4.2%.

-Migration to Bitcoin City

Billionaire investor Christian Angermayer has left the UK, citing the country’s tax hike plans, and relocated to Switzerland’s Bitcoin hub, Lugano. Angermayer recently spoke at the Token2049 conference about how Bitcoin creates a shared bond by liberating people from their governments.

-BTC:

Bitcoin (BTC) has garnered attention by posting three consecutive weeks of gains for the first time since February. According to TradingView data, Bitcoin is attracting investors with call options offering upside potential above $75,000 amid this upward trend.

In the seven days leading up to September 29, Bitcoin saw a value increase of more than 3%, continuing the 7% rise seen over the previous two weeks. Strong inflows into spot ETFs listed on U.S. exchanges contributed to this rise, as the inflows were equivalent to more than a month’s worth of newly issued BTC supply. These inflows had a positive impact on price movements.

Bitcoin’s price increase during this period not only boosted investor confidence but was also seen as a signal of a long-term bull market. The rise in Bitcoin, particularly driven by major investors and institutional inflows, continues to be supported.

-If we interpret Bitcoin with ITB analysis:

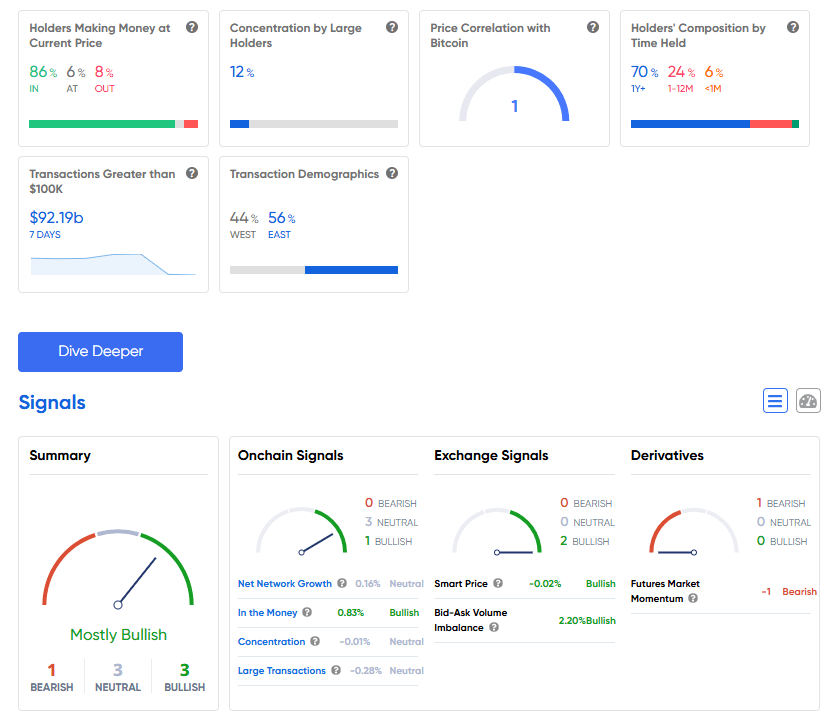

Large investors continue to accumulate Bitcoin. According to the latest data, the profit ratio of Bitcoin holders has reached 86% this week. The transaction volume of whales, who hold significant positions in the crypto market, has reached $92.19 billion. According to ITB analysis, market expectations are shaping up as 1 “Bearish,” 1 “Bullish,” and 3 “Neutral.”

The U.S. Non-Farm Payroll data to be announced on Friday could lead to movements in the crypto markets. Given the potential volatility after this data, it is crucial to manage risk in our trades. Using “Take Profit” and “Stop Loss” orders can result in healthier and more sustainable outcomes.

During this period, it is essential for investors to closely monitor the market, base their strategies on up-to-date analysis, and keep an eye on economic data and whale movements to see the impact on Bitcoin and other cryptocurrencies.

‘’Bu araştırma raporunda yer alan yatırım bilgi ve yorumları yatırım tavsiyesi niteliğinde değildir.’’

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.