Economic Expectations for the Week:

| Date | Time | Currency | Event | Expectation | Previous Month Data |

|---|---|---|---|---|---|

| September 2, Monday | USD, USDCAD | U.S. and Canadian Markets Closed All Day Due to Labor Day | |||

| September 3, Tuesday | 10:00 | TRY | Consumer Price Index (CPI) in Turkey (Yearly) | 52.20% | 61.78% |

| September 4, Wednesday | MATIC | Polygon’s (MATIC) name will change to POL | |||

| September 6, Friday | 15:30 | USD | U.S. Non-Farm Payrolls (Aug) | 164K | 114K |

| September 6, Friday | 15:30 | USD | Average Hourly Earnings (Monthly) (Aug) | 0.3% | 0.2% |

| September 6, Friday | 15:30 | USD | Unemployment Rate (Aug) | 4.2% | 4.3% |

-Pavel Durov Released

French prosecutors announced that Telegram’s CEO, Pavel Durov, was released following a four-day interrogation related to allegations that the platform was used for illegal activities. In a statement, the Paris Prosecutor’s Office said, “The investigating judge has ended Pavel Durov’s police custody and decided that he will appear in court for future hearings and a possible indictment.” Durov was detained at Le Bourget airport near Paris as part of a judicial investigation launched last month that includes 12 separate charges. Durov’s release is seen as a significant step in the ongoing legal process, with the allegations against him expected to become clearer in future hearings. The outcome of the investigation into the use of Durov’s platform, Telegram, for illegal activities will be closely watched by both the legal and technological communities.

In the last 24 hours in the cryptocurrency market;

-Bitcoin Whales Continue Accumulating

-Bitcoin Whales Continue Accumulating

According to the latest data, the number of wallets holding 100 or more Bitcoins increased by 283 in August, reaching the highest level in 17 months. This rise has led to whales accumulating more Bitcoin, especially as smaller investors sell off. Despite the drop in Bitcoin’s price, large investors continue to maintain their long-term accumulation strategies.

Starting in September, Russia is taking a significant step in its financial system to counter U.S. sanctions by experimenting with the use of cryptocurrency exchanges and digital tokens for cross-border transactions. This initiative aims to facilitate exchanges between rubles and cryptocurrencies, providing a solution to the international payment difficulties caused by the sanctions. If these trials prove successful, an official cryptocurrency platform could be launched by 2025, potentially leading to a major shift in Russia’s financial system. The decentralized nature of cryptocurrencies could usher in a new era for Russia’s international trade and financial transactions. These trials also hold the potential for Russia to become a powerful player in the global crypto market. If successful, this move could be a significant milestone not just for Russia but also for the widespread adoption of cryptocurrencies worldwide.

-Trump’s New NFT Collection Generates $2 Million in Revenue

Former President Donald Trump’s latest NFT collection, titled “Series 4: America First Collection,” has garnered significant interest, generating over $2 million in revenue despite the global slowdown in the NFT market. These digital collectibles feature various images of Trump and were sold at $99 each. Widely promoted to support Trump’s brand and image, the collection attracted attention among NFT enthusiasts and investors.

Analysts suggest that such collections could hold substantial value in the future, with investors potentially approaching these assets strategically. Trump’s NFT collection is seen not only as a digital art piece but also as an investment and cultural phenomenon. This collection is viewed as a successful move in strengthening Trump’s influence in the digital world and expanding his brand’s reach to a broader audience.

BTC:

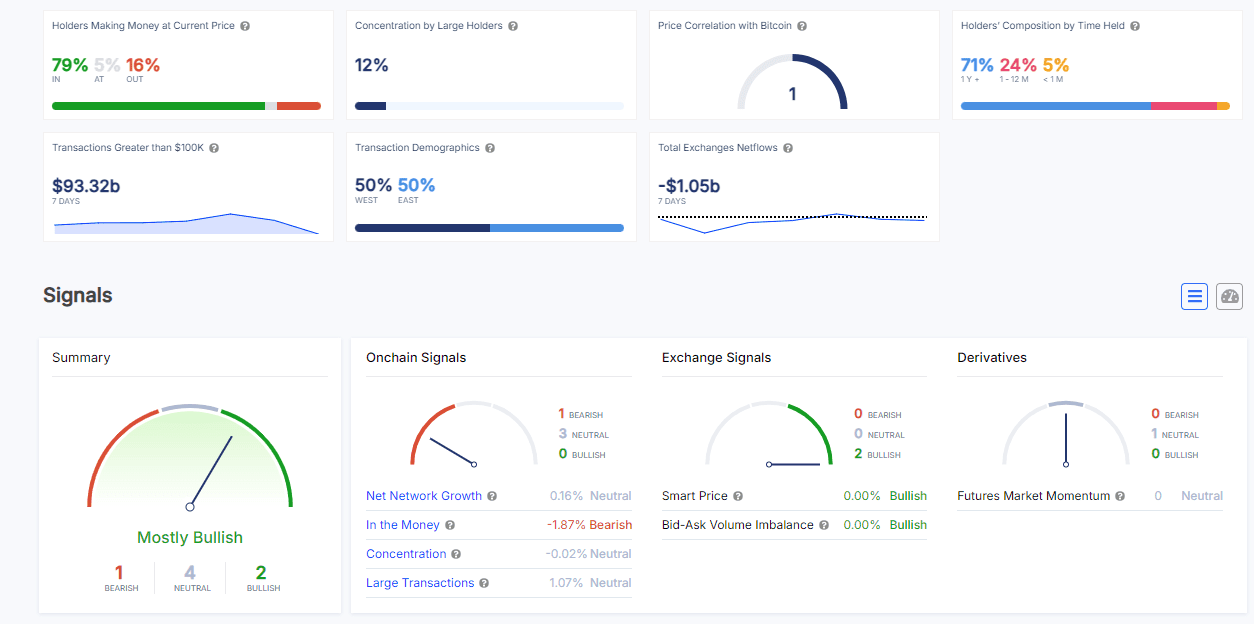

This week, ITB analysis for Bitcoin shows an increase in whale activity, with large investors continuing to accumulate BTC. The profit ratio for Bitcoin holders is seen at 79% this week. Whale trading volumes have risen to $93.32 billion. According to ITB analysis, there are 1 “Bearish,” 2 “Bullish,” and 4 “Neutral” expectations.

“The investment information and comments included in this research report do not constitute investment advice.”

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.