The release of this week’s most critical data, Non-Farm Payroll, is just hours away. But why is this data so important?

Non-farm payroll data, an essential economic indicator, reflects the total number of employed workers excluding those in the agricultural sector. Released on the first Friday of every month in the U.S., this data plays a crucial role in understanding labor market health, unemployment rates, and economic growth trends. Non-farm payroll data is closely monitored by investors, economists, and central banks as it informs economic policy decisions.

Non-Farm Payroll Data and Other Indicators

The Non-farm payroll data is released alongside two other important figures:

- Average Hourly Earnings

- Unemployment Rate

Together, these three indicators provide a clearer picture of the labor market and the economy’s progression.

Fed’s Rate Cut and the Labor Market

Earlier this month, the Fed initiated a rate cut cycle with a significant 50 basis point reduction. However, labor market data is one of the key determinants of how quickly and by how much the Fed will continue to cut rates. Therefore, non-farm payroll data holds substantial importance in the markets and is closely watched.

ADP Non-Farm Employment Data (Leading Indicator)

The ADP non-farm employment data, released every Wednesday, is considered a leading indicator for the official Non-Farm Payroll data. This report measures private sector job creation and often reflects trends seen in the official NFP data. However, it may not always align perfectly since the official Non-Farm Payroll report includes public sector employment and broader economic activities.

| Data | Released | Expectation | Previous Month’s Data |

|---|---|---|---|

| ADP Non-Farm Employment | 143K | 124K | 103K |

The ADP data, surpassing expectations at 143K, would typically have a positive impact on markets. However, current geopolitical risks have dampened investor sentiment, resulting in a negative market atmosphere. Now, all eyes are on the official Non-Farm Payroll data. Should this data exceed 150K, it could signal a healthy recovery in the labor market. Conversely, if it falls short of expectations, it may indicate a slowdown in economic growth, potentially bringing recession concerns back into the spotlight. Weak employment growth would suggest ongoing challenges in the labor market. This scenario could lead investors to seek safe-haven assets, possibly impacting Bitcoin and other risky assets negatively.

Bitcoin Through ITB Analysis:

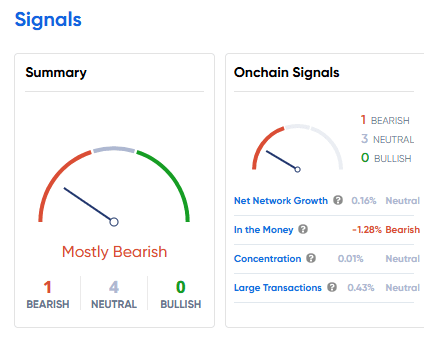

According to ITB analysis, there is currently “1 bearish,” “4 neutral,” and “0 bullish” sentiment for Bitcoin, indicating a downward trend with no strong signals for an upturn. Bitcoin network growth remains at 0.16%, suggesting stagnant participation and cautious behavior among investors.

Bitcoin Investors Seek Greater Stability Amid Market Movements

Bitcoin investors are increasingly searching for more stability in market movements, and currently, there is a noticeable lack of a strong catalyst for a Bitcoin price increase. However, at this stage, it’s worth noting that Non-Farm Payroll data can serve as a guiding indicator for investors. For instance, when Non-Farm Payroll data shows a downward trend, it can be perceived as a recession signal, hinting at a weakening U.S. economy. During periods of economic uncertainty, investors tend to gravitate toward safe-haven assets, which can put pressure on Bitcoin prices.

When recession fears escalate, demand for digital assets like Bitcoin may decline. Therefore, when trading Bitcoin, it’s crucial to consider macroeconomic indicators, particularly Non-Farm Payroll data and the likelihood of a recession.

Research Specialist at EgeMoney

My areas of expertise include fundamental and technical analysis, portfolio management, risk analysis, and market research. Adapting to rapidly changing market conditions and producing reports are among my top priorities. Through my research on the EgeMoney platform, I aim to shape your financial future and add value to your decision-making processes.